Greek daily renewable production reached a record peak of 3,106MW on 7 October, marking the first time in history that the power system of the country covered its supply with 100% renewable power generation for 5 hours. This development comes as the result of accelerating investments in the solar and wind capacities of the country.

Prime Minister K. Mitsotakis declared on 11th of October that the country emerges as a leading producer of renewable electricity, as, for 2021, the country ranked 12th in the world in share of solar in electricity generation mix and 8th in the world in share of wind. PM Mitsotakis pledged to accelerate the development of the renewable power generation capacity.

With a solar and wind electricity generation capacity of 8GW in 2021, the country experienced an accelerating rate of expansion of its renewable capacity. Solar increased on average by 10.1% per year between 2018 and 2021, from 2,652MW to 3,530MW, and wind increased on average by 15.91% per year, with capacity developing from 2,877MW in 2018 to 4,457MW in 2021.

Graph 1: Installed capacity development in Greece by technology.

Source: IRENA

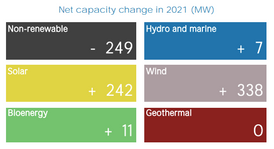

Graph 2: Net capacity change by technology in Greece in 2021.

Source: IRENA

In July 2022, the Greek government launched a public consultation process on a new draft bill that sets the target of a 2GW development of offshore wind farms by 2030. The bill sets the procedures for the facilitation of the technical studies that delimitate the Areas of Organized Development of Offshore Windfarms, which will effectively be predefined spaces for the development of offshore wind farm projects. In addition, the requirements set for the economic actors that are willing to participate in the public competitions for the projects are set to a minimum.

Important investment interest has been demonstrated by foreign and domestic investors for wind and solar projects in Greece. Domestically, the major refining industries of the country are making a pivot to renewable energy with the target of shedding their refining identity and transforming into energy companies. HELPE Renewables, has declared the target of achieving a renewable portfolio of 600MW by 2025 and 2,000MW by 2030 from 400MW in 2022 while Motor Oil Renewable Energy is developing another 80MW of renewable energy and storage projects that combined with recent takeovers of existing solar and wind farms will amount to a portfolio of more than 856ΜW with the target of reaching 1GW. Among the other companies with important renewable portfolios and TERNA Energy is currently developing an additional 400MW to its 860MW portfolio. In addition, DEI Renewables (Public Power Company) with a current portfolio of 180MW, 395MW being constructed and 260MW being planned.

The initial NECP published in 2019 aims for increased use of RES by 2030:

The National Climate Law (Law 4936/202), voted by the Parliament in May, sets the path to achieve decarbonisation by 2050 and prohibits the production of electricity from solid fossil fuels from 31 December 2028. The major points of interest in the new climate law:

The targets of the new Climate Law are in accordance with the targets set by the Fit-for-55 Package. Among them are:

In June 2022, the Parliament approved a bill for the simplification and acceleration of licensing procedures for renewable projects. The target that was set was to decrease the time required for the licensing from 5 years to 14 months. In an interview with business news outlet Insider, the vice president of the Hellenic Association of Renewable Power Producers stressed that out of the 1450MW of wind capacity that were included in public competitions during the period 2018-20, only 250MW have been completed up to now. The bill also includes measures for the simplification of the rules of issuance and auctioning of GoOs (Guarantees of Origin).

DAPEEP, which is the disclosure body and the issuing body (according to the Ministerial Decision of 10/8/2022), aims at holding the first auction of GoOs in Greece in the following months. The legal framework permits export of GoOs to AIB members with no limitations but permits import of guarantees only from EU countries and countries that issue their GoOs according to the Renewable Energy Directive II and the Energy Efficiency Directive.According to the new framework on the issuance of GoOs established by the new bill, a certificate is issued in favour of the producer if the renewable project is not receiving a Feed-in-Tariff, a Feed-in-Premium or operational support (Law 4951/2022) and the guarantees that are issued from producers that receive subsidies are auctioned in favour of the issuing body Renewable Energy Special Account, that finances the FiT and FiP subsidies schemes.

Veyt specialises in data, analysis, and insights for all significant low-carbon markets and renewable energy.