So far, EUA auctions have raised €2 bn for the REPowerEU programme and more will be added up to the last session this year, on 18 December. We know the planned volume for next year, but we still await the 2024 calendar that will provide clarity on the exact timing.

The extra sale of emission allowances (EUAs) is set to contribute €20 billion to the REPowerEU programme which should help Europe end its dependence on Russian fossil fuels and accelerate the transition to renewable energy (the lion’s share of the €320 bn programme will come from the Resilience and Recovery Facility, a source of funding created during the covid pandemic). The REPowerEU Regulation which entered into force on 1 March 2023) stipulates clearly that the monetisation of frontloaded EUAs should start in 2023 and conclude by August 2026. The objective is defined in terms of value – the €20 billion – hence the final volume of EUAs to be sold will depend on how the price per unit evolves in the years to come.

That said, the European Commission, in close cooperation with the EEX auction platform, will at regular intervals need to set volumes for the immediate months ahead and communicate these clearly to market participants who will expect predictability on forthcoming volumes.

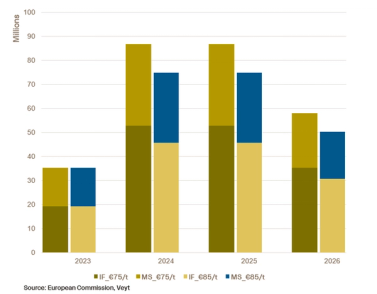

A more detailed timeline is provided in the Commission Regulation to update the ETS auction rules, a piece of secondary legislation adopted by the Commission on 17 October 2023. Article 10 (6) sets the preliminary volumes to be 34.8 m in 2023, followed by 87 m EUAs both in 2024 and 2025 and then 58 million in 2026 (eight months only). We thus arrive at a total volume of 267 m. The Commission has clearly based this amount on an estimated average price of €75/EUA, which would yield €20 billion. If the average price moves above that estimate, a smaller amount will need to be monetized, and vice-versa.

The first batch of 543,000 allowances redirected to REPowerEU was sold as part of the EUA auction on 3 July 2023, bringing in €47m. Now, in late October, the cumulated volume is approaching 24 m, and the total accrued revenue crossed the €2 billion mark with the action on 30 October. By year’s end, 35 m EUAs will have been sold for REPowerEU, for an expected aggregate value of near €3 bn (estimate based on actual auction prices until 30 October and our Q4 price forecast of €88/t for the upcoming auction sessions).

The EUAs sold for REPowerEU are partly sourced from the Innovation Fund, and partly from member states’ auctions (volumes originally reserved for the years 2027-2030). Overall, for the whole period 2023-2026, the split is set at 60-40, i.e., €12 billion, and €8 billion, respectively.

To put the size of the REPowerEU sale into perspective, the full auction volume available in 2023 is 427 m, of which 304 m is sold for the benefit of member state governments. Of the remainder, 67 m is earmarked for the Modernisation Fund, 35 m goes to REPowerEU, and a smaller volume of 21 m is what is left for the Innovation Fund this year.

The draft Commission regulation lists REPowerEU volume adjustments – to align the trajectory with the €20 billion revenue goal – as one of several reasons that can trigger an update of the auction calendar. Adjustments will be made based on the average auction clearing price for the preceding six months, the revenue already accrued, and the time left until 31 August 2026.

If we apply an average price of €85/t, it will be sufficient to sell 236 m units, rather than the 267 m resulting from the current, preliminary plan. The difference can be seen in Figure 1, which also highlights which volumes are sourced from the Innovation Fund, and which from the member states’ auction volumes.

In the event that the revenue accrued reaches the €20 billion threshold ahead of the foreseen timeline, all future REPowerEU auctions will be halted.

Under the European Commission’s current assumptions, some 87 m EUAs will be auctioned for the REPowerEU programme in 2024, again partly sourced from the Innovation Fund, partly from member states’ volumes. The big question right now is when exactly the extra volume will hit the market, and how it will be spread out over the year.

The existing EEX calendar for EUA auctions expires on Friday 5 January 2024, with the last auction taking place on 18 December. EEX is preparing a calendar for 2024, but the revision of the Auctioning Regulation which is technically speaking still ongoing risks delaying the process. The European Commission adopted the new text on 17 October, and we are now in a two-month scrutiny period during which the European Parliament and/or the Member States in the Council could theoretically scrap it.

That is not likely to happen, and we can probably assume that the delegated act will enter into force in mid-December. Once that is in place, the EEX will move fast to issue an auction calendar for 2024.

If the EEX does not receive the necessary instructions from the European Commission in time, it will probably be forced to publish a preliminary calendar, to show the size of the auction on Monday 8 January and the following weeks.

Then, once the revised Auction Regulation enters into force, the calendar would need to be updated, to include the REPowerEU volumes that will start being auctioned, most likely in late January.

Alternatively, the Commission and EEX might agree to postpone the start of 2024 auctions by a week or two, to avoid circulating a calendar that will immediately need to be replaced.

In either case, the calendar will surely be adjusted several times until the REPowerEU sale is set to end in August 2026. Just how often is not yet clear. For the sake of predictability and to avoid extra administrative work, the Commission will probably seek to limit the number of updates. On the other hand, it will need to react to the EUA price fluctuations. We could easily see more than one update per year.

The timing and volume of the REPowerEU sale is not the only interesting element in the text that was adopted on 17 October. It is worth noticing that going forward there will no longer be a halving of auctions in August and that the compliance deadline for the surrender of allowances changes from 30 April to 30 September.

Veyt specialises in data, analysis, and insights for all significant low-carbon markets and renewable energy.