Abu Dhabi-based chemical company Fertiglobe has won the inaugural H2Global auction in a deal to supply renewable ammonia into northwest Europe at a delivered price of EUR 1,000/ tonne.

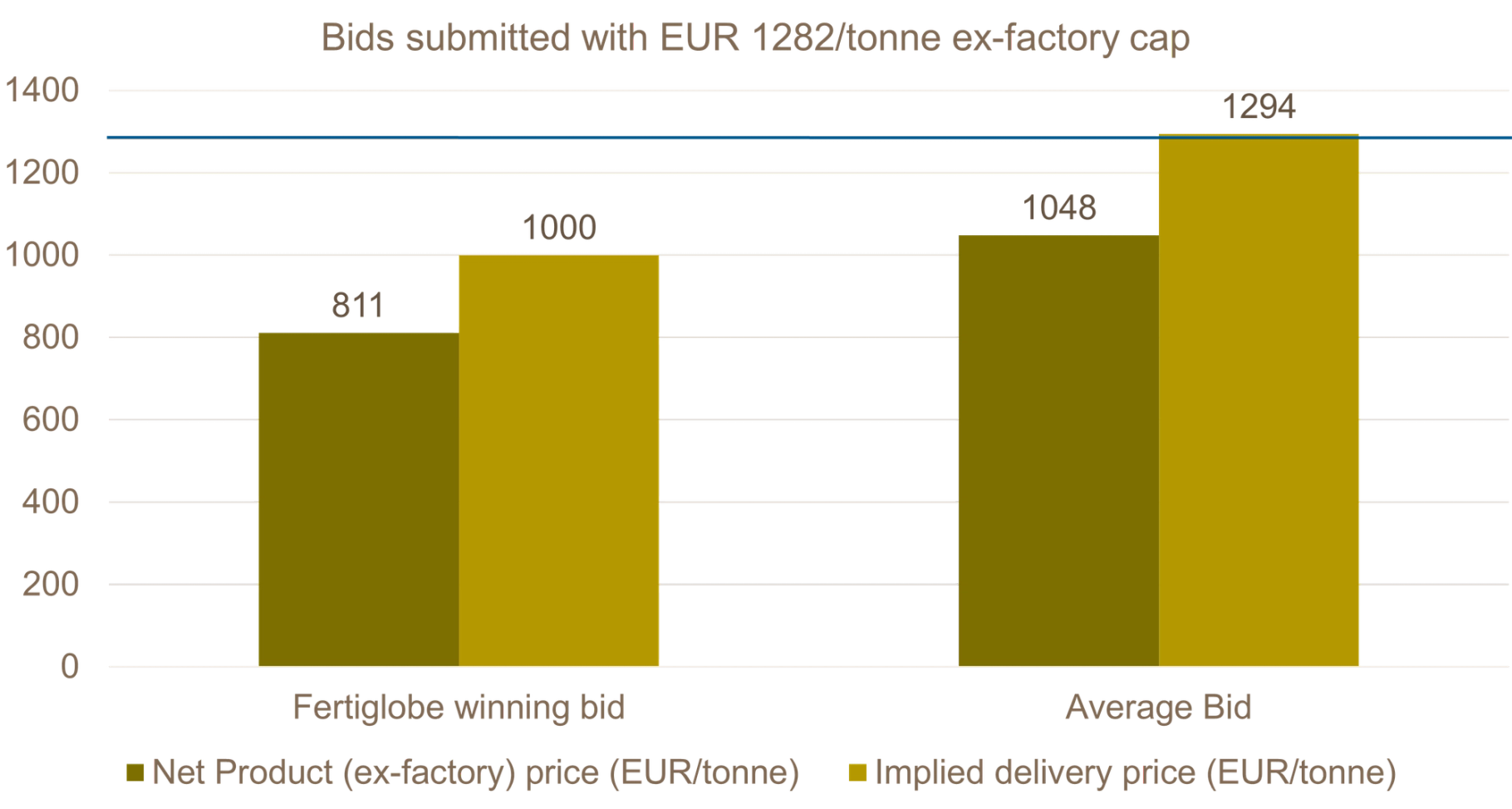

Under the deal announced on 11 July, Fertiglobe would supply up to 397,000 tonnes of renewable ammonia into the port of Rotterdam from 2027 to 2033, with volumes ramping up from 19,500 tonnes to at least 40,000 tonnes/year. The ex-factory price of the renewable ammonia, before duties and delivery, was EUR 811/tonne, 23% below the average bid submitted and 37% below the bid cap, according to H2Global subsidiary Hintco.

The fuel would be sourced from Egypt Green, a 74,000 tonne/ year renewable ammonia project in Ain Sokhna on Egypt’s Red Sea coast. Egypt Green, which is 46.2% owned by Oslo-based renewable energy developer Scatec, would source electricity to an 100MWel electrolyser from a 203MW wind farm and 70MW solar PV plant connected to the facility via the Egyptian electricity grid. Renewable hydrogen would in turn feed Fertiglobe’s 2009-built EBIC ammonia plant.

The winning bid was selected from 22 companies or consortia across five continents, with a shortlist of five from Asia, North Africa, Middle East and South America invited for the final round. The average net product, or ex-factory price before shipment and duties, of the bids was EUR 1,048/tonne, according to Hintco.

The pilot auction, launched in 2022, had been set to award up to EUR 900 million split across three lots. The third lot, to secure synthetic aviation fuel (e-SAF), failed to secure a firm bid, according to the auction operator, while, the second lot, for renewable methanol projects, was ongoing.

The H2Global Foundation is a partnership between industry and government created as a mechanism to conduct double-sided auctions, via its subsidiary Hintco, in order to enable price discovery and procurement of renewable fuel imports into Europe. The auction was funded by the German Federal Ministry for Economic Affairs and Climate Action (BMWK).

The results of the renewable ammonia lot of the auction demonstrate the existence of a market, which is competitive against H2Global’s original expectations as well as revealing information on the preferences of project developers.

From all of the bids received, the average ex-factory price was EUR 1048/tonne, falling comfortably below the cap set by H2Global of EUR 1282/tonne. Given the awarding body’s statement that this composed 81% of total cost, this implies an average delivered price of EUR 1294/tonne into NW Europe. This represents roughly 175% of the spot price for fossil-based ammonia delivered into northwest Europe in July 2024, although the winning bid was closer to double the current spot price, which excludes a carbon adjustment.

Figure 1: Pricing of bids submitted to H2Global Pilot auction (Hintco/ Veyt)

The average project size across the 22 bidders was 145MWel electrolyser with 295MW of additional renewable energy, according to Hintco. The projects offered quantities of renewable ammonia in a range of 210,000 to 475,000 tonnes, with maximum contracted volumes capped by Hintco at 40,000 tonnes/year.

All of the bidding projects opted to use alkaline electrolysers and all but one proposed delivery into the Dutch port of Rotterdam.

The initial bidders were refined by Hintco partly on their maturity of projects, which were required to have preliminary financing agreements, advanced engineering plans and completed a Draft Environmental Impact Statement. The five shortlisted bidders were then invited place final and binding financial and technical bids according to a Hydrogen Purchase Agreement (HPA), which was standardised over the course of the auction.

As a result of this process, Hintco claimed to have derived learnings from the auction on project scale, access to ports and the challenges for international bidders posed by Europe’s shifting regulatory environment.

The organisation was obliged to accommodate total delays of seven and a half months, due in part to questions posed by negotiating while Delegated Acts for RED II and the EU Carbon Adjustment Mechanism (CBAM) were adopted in mid-2023. Hintco also reflected the pilot auction’s cap on volumes fell below the level needed by some bidders achieve economics of scale, with one withdrawing citing the high regulatory burden to achieve for a small share of total production.

Winning bidder Fertiglobe is a chemical firm currently jointly owned by OCI and Abu Dhabi state oil and gas company ADNOC, although the latter agreed in December to buy out the Dutch chemicals company’s 50% stake in the company for USD 3.62 billion (EUR 3.32 billion).

Egypt Green is a scheme to decarbonise Fertiglobe’s existing ammonia plants at Ain Sokhna using renewable hydrogen. In October 2021, Norwegian project developer Scatec and consortium partner Orascom Construction agreed to construct 100MW of electrolysis capacity adjacent to Fertiglobe’s 748,000 tonne/year EBIC ammonia facility, although to date only a 15MWel pilot electrolyser has been completed. A final investment decision (FID) on the larger scheme is now expected in H1 2025.

In order to ensure RFNBO-compliance, the project would commit to monthly matching until 31 December 2029 and thereafter hourly matching of renewable supply from the renewables projects, which would be connected to plant via Egypt’s national grid. The successful bid underwent further scrutiny by certification bodies TÜV Süd and GUTcer, Hintco confirmed.

The produced renewable ammonia would achieve a reduction in emissions intensity of 75.5% relative to unabated fossil ammonia, equating to an emissions intentity of 0.432t CO2eq/t NH3, the auction body said.

The deal would not be the first compliant shipment from the facility. In November 2023, a shipment from the pilot phase was the first renewable ammonia to receive ISCC PLUS certification and sold as part of a deal with consumer chemical firm Unilever in India to produce near zero carbon laundry powder from soda ash.

In its Annual Report published in May, Fertiglobe described the production capacity of Egypt Green as up to 90,000 tonnes/year, implying the volumes offered to H2Global will exclude the pilot phase or that the capacity factor has been reduced to comply with RFNBO criteria.

The USD 430m (EUR 395 million) Egypt Green hydrogen project and 273MW renewables portfolio would be supported by an USD 80 million (EUR 74 million) equity bridge loan by the European Bank of Reconstruction and Development (EBRD), the multilateral lender announced in March 2023.

| Project Title | Egypt Green Hydrogen |

|---|---|

| Renewable Ammonia Supplier | Fertiglobe PLC (“Fertiglobe”) |

| Project Partners (Renewable Energy and Hydrogen) | Scatec ASA, Orascom Construction, The Sovereign Fund of Egypt, Egyptian Electricity Transmission Company |

| Contractual Partner (Off-taker) | HINT.CO GmbH, Germany (hereafter “Hintco”) |

| Project Location | Suez Canal Economic Zone (SCZONE), 120 km southeast of Cairo, Egypt |

| Average Product Price (FOB) | 811.30 €/t (net price without value added tax) |

| Total Contract Price Delivered to Europe | 1,000.00 €/t (contract price without value added tax; including transportation, logistics, customs) |

| Contractual Maximum Supply Commitment | 19,500 t in 2027 (depending on supply availability during ramp up period), from 2028 up to 73,000 t per year; in total 397,500 t until 2033 |

| Contractual Offtake Commitment | 19,500 t in 2027, from 2028 40,000 t per year; in total 259,500 t until 2033 |

| Electrolyser Technology | Pressurized alkaline; 100 MW; 13,000 t renewable H2 per year. Final decision on manufacturer not yet taken |

| Ammonia Production | Up to 74,000 t per year |

| Electricity Sourcing | Newly built renewable energy capacity; ~203 MW onshore wind + ~70 MWp PV |

| Emissions Intensity | Approx. 75.5 % reduction compared to grey ammonia; the emissions savings associated with the contractual maximum supply commitment |

Figure 3: Egypt Green key facts overview (Hintco)

As the inaugural competition designed to secure international renewable ammonia volumes, the results of the auction are likely to have ramifications for pricing, and the design of future policy support.

Given one of H2Global’s stated objectives is to aid market development through discovery of ‘willingness and ability to pay for renewable ammonia in Europe’, the pricing achieved by the inugural contract will be closely scrutinised.

Egypt Green has a number of headstarts over some competing international projects, beyond its host country’s renewable energy potential. Not only does it benefit from the pre-existence of a relatively modern ammonia plant, but it has already been supplying certified renewable ammonia volumes from a pilot facility. Additionally, it has not only access to multilateral funds from the EBRD but backing from the large balance sheet of ADNOC.

Newbuild facilities may face hurdles to clear the EUR 1,000 tonne threshold, which is neverthless likely to set an influential threshold for Rotterdam delivery.

For the German government and the Commission, there will also be a mixture of encouraging signs and notes of caution from the result. They will likely be encouraged, from a supply security perspective, that the five shortlisted bidders were drawn from four different global production regions. Alongside the number and competitive bids, this would also strengthen renewable ammonia’s claim to be a maturing market worthy of investment in supporting infrastructure.

However, Hintco’s reports of bidders being discouraged by the regulatory hurdles required to sell relatively small volumes of ammonia represent an opportunity as well as a challenge. Scaling bid volumes to match the ambition of projects in the market should permit economies that would be reflected as H2Global deploys the larger funds available through the German government’s commitment of EUR 3.5 billion to future rounds of the double-auction process.

| Auction | Status |

|---|---|

| Lot 2 Ongoing (renewable methanol) | Ongoing |

| Lot 1 (renewable ammonia) – HSA auctions | Expected in 2025/26 |

| EUR 3.5 billion round of auctions | In preparation -> currently conducting market consultations |

| EUR 300m + EUR 300m Netherlands-Germany Joint Auction | In preparation |

Figure 4 Upcoming Auctions (Hintco)

Veyt specialises in data, analysis, and insights for all significant low-carbon markets and renewable energy.