On 11 Jan 2024, the International Energy Agency published the Renewables 2023 report, detailing their analysis and forecast of sector growth to 2028. This current edition contains a section dedicated to biogas and biomethane with regional breakdowns.

In 2022, the total global production of biomethane and biogas by energy content was estimated at more than 1.6 EJ. While this is a relatively low amount of energy compared to renewable power generation (around 7800 TWh or 28 EJ according to IRENA statistics), the IEA highlights the technology as ready-to-use and promoting security energy supply, where gas imports can be unpredictable at this time of heightened geopolitical tension.

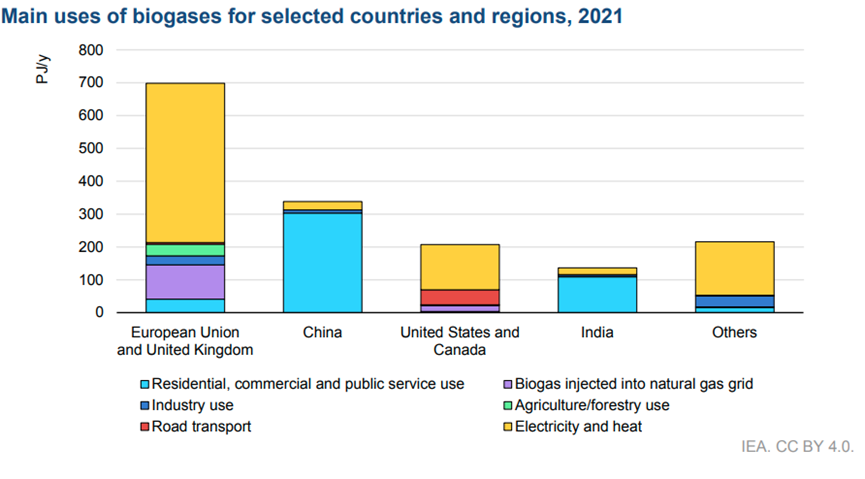

The region/sector breakdown is given below:

From IEA, Renewables 2023 – pg 132

While China and India have high energy uptake, this is mainly the direct use of biogas rather than the more versatile upgraded biomethane product. Moreover, biogas production is typically via small-scale digesters, where the gas collected is usually restricted to heating purposes for households and small buildings.

There is a drive in these countries for larger installations, which will allow biogas production economies of scale which make power generation viable, diversifying usage. The IEA report goes into further detail about specific initiatives and policies which affect biogas development.

Europe and North America have more mature biogas sectors, which is reflected not only in volume or energy production but also in the proportion of biomethane produced. Biomethane is more versatile than non-upgraded biogas, making it easier to transport where it can be used by difficult-to-electrify demand sectors. Europe leads the way with biomethane grid injection, whereas North America has opted for biomethane as a road transport fuel.

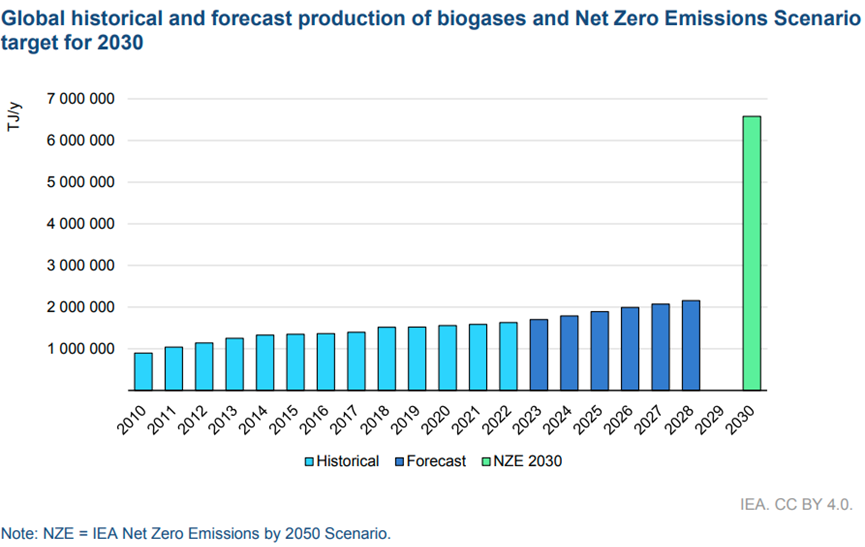

According to the IEA Net Zero Scenario (NZS), the most aggressive of the three scenarios considered under the Global Energy and Climate Model, biogas energy (total non-upgraded biogas plus biomethane) would quadruple from current production to more than 6.6 EJ per year in 2030.

From IEA, Renewables 2023 – pg 141

While all regions are expected to increase production over time, from 2023 to 2028 the bulk of the growth is slated to come from the mature markets of Europe and North America. Growth in China, India and other regions is limited by infrastructure, including underdeveloped gas and electrical grids. However, post-2028 accelerated growth is expected. Nevertheless, the gap between projections for 2028 and the NZS is significant.

While not discussed in the report, the global trade of biomethane will rely on the individual regions investing and supporting upgrading facilities, as well as port infrastructure for liquefaction and shipping. Legislation must also play a part in developing demand, via obligation schemes or green labelling requirements.

However, it is unclear whether a truly international market for biomethane will arise. Biomethane is often viewed as a local, feedstock-constrained renewable energy source.

In contrast green hydrogen, while still in its infancy has already seen many developments which suggest global outreach, including Germany’s National Hydrogen Strategy and the recent COP28 push for alignment on hydrogen certification.

Veyt specialises in data, analysis, and insights for all significant low-carbon markets and renewable energy.