The Commission’s internal estimate for renewable hydrogen uptake by 2030 is in the 3 to 6 million tonnes range, while EU countries ask for the re-evaluation of the RFNBO rules.

The Commission’s internal estimate for renewable hydrogen uptake by 2030 based on the mandatory targets is 3 to 6 million tonnes (Mt), wrote Energy Commissioner Dan Jorgensen in response to a parliamentary question. It is unclear whether the downgraded estimate refers to both domestic hydrogen production and imports or not. Currently, the EU aims for 10 Mt of domestic hydrogen production and renewable hydrogen imports each by 2030.

Separately, a group of European countries asked the Commission for an earlier-than-scheduled evaluation of the renewable hydrogen production rules given the difficulties the sector faces as it scales up. The suggested removal of the additionality requirement and loosening of the temporal matching rules, if implemented, could have a bullish impact on the renewable European Energy Certificates System (EECS) guarantees of origin (GO) market as hydrogen producers would compete with other GO offtakers for the same renewable supply.

The latest projections are based on quotas from the revised Renewable Energy Directive (RED III), the ReFuelEU Aviation and FuelEU Maritime regulations, while the 20 Mt target is noted as aspirational, rather than legally binding. Indeed, the target features in the European Hydrogen Strategy and RePowerEU. The latter fed into the updated RED.

However, both the Renewable Fuels of Non-Biological Origin Delegated Act (RFNBO DA) and RED III outline EU-wide percentages rather than volume-based targets (see table).

Sector | Subsector | Target in revised RED |

|---|---|---|

Transport | Overall transport | 5.5 % share of advanced biofuels and RFNBOs, in final consumption of all energy supplied to transport, with a 1 % RFNBO minimum share |

Member States with maritime ports | min. 1.2% of RFNBOs in 2030 | |

Industry | Contribution of RFNBOs for final energy and non-energy purposes shall be at least 42% and 60% of the hydrogen used in industry in 2030 and 2035, respectively (Art. 22(a)) |

In a separate development, twelve European countries in the Council, led by Czechia, call for an expedited reassessment of the RFNBO DA ahead of the planned schedule by 1 July 2028. They ask the Commission to:

Earlier in 2024, German Economy Minister Habeck sent a letter to the European Commission asking to relax RFNBO rules. His requests included postponing the additionality phase-in period to 2035 instead of 2028 and extending monthly temporal matching by one year to the end of 2030 (vs. 2029 per current rules).

The internal downgrading of the hydrogen target is indicative of a reality check within the Commission’s walls. In 2024, the European Court of Auditors (ECA) reviewed the Commission’s work for the renewable hydrogen market development and determined that the EU is unlikely to meet its 10 Mt ambition by 2030.

The downgrade also resolves an internal inconsistency in the Commission’s renewable hydrogen capacity and consumption targets. As cited in the ECA report, the Commission’s official 40GW domestic electrolyser target fell short of the capacity needed to produce 10Mt of hydrogen by up to 100GW at operating rates consistent with RED rules on temporal correlation and additionality.

The Commission has previously used a figure of 9 million tonnes of oil equivalent (approximately 3Mt in hydrogen terms), in a working document on 2040 climate targets. However, the report did not cite the higher 6Mt figure.

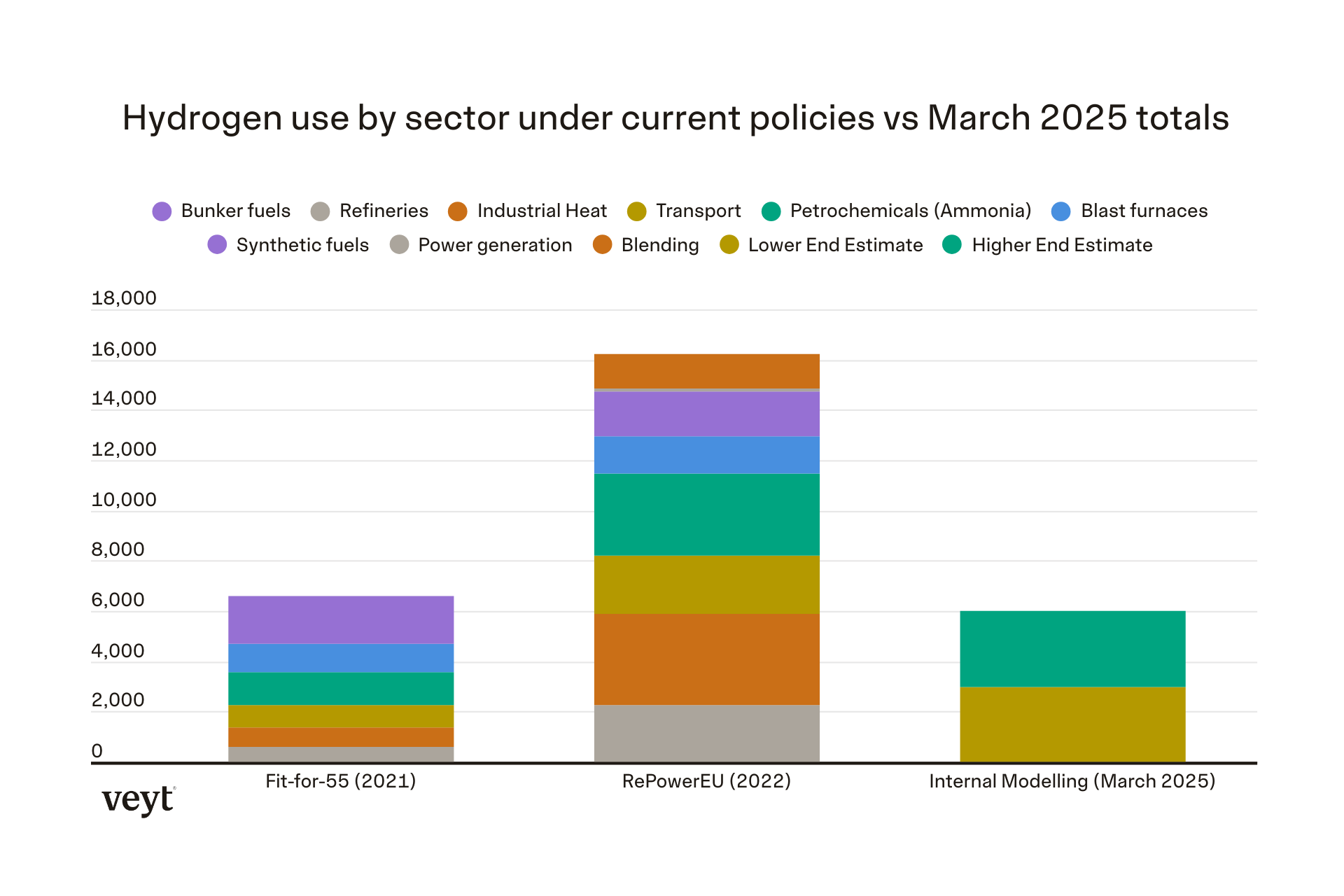

The Commission’s internal modelling has evolved over time in line with changing policy targets. In 2022, a Commission staff working paper implied that levels of hydrogen consumption consistent with RePowerEU would raise the amount available to the industrial heat sector by 4.8 times compared to the earlier Fit-for-55 policy to 3.6 Mt. Incumbent hydrogen use sectors such as refining and ammonia were expected to consume 2.2 Mt and 3.2Mt of renewable hydrogen, which would represent 47 % and 165 % of 2023 consumption retrospectively, according to European Hydrogen Observatory data.

Thus, the current projections represent more conservative assumptions than implied by either previous policy position and are instead understood to align with industry sector-specific RFNBO targets unveiled in 2023.

The lower targets reflect the competitive pressures faced by several of Europe’s current and potential hydrogen end-use sectors, on which the effects of the current RFNBO regulation will fall unevenly.

The Commission announced on 19 March 2025 that the steel industry, which is not bound by a specific hydrogen usage target, would be prioritised for further support for the transition to clean hydrogen.

Parts of the refining sector, which is instead covered by the target for at least 1 % RFNBO target in transport fuels, have embraced the use of renewable hydrogen. TotalEnergies signed a contract to purchase renewable hydrogen from utility RWE for its Leuna refinery in Germany, in a deal which takes the Paris-based energy group’s purchases of ‘green’ hydrogen to over 200,000 tonnes per year, 40% of its target for the fuel. Around 92,000 tonnes of this has been sourced from European-produced electrolytic hydrogen, with the balance sourced from biological hydrogen and imported RFNBO-compliant ammonia.

However, at an ERCST event on 11 March 2025, a spokesperson for industry body Fertilizers Europe said, ‘When it comes to real life the fertiliser to use for agriculture, there is no business case for [RFNBO ammonia]’, while maintaining domestic European production. The organisation has called for ‘greater flexibility’ in interpretation of RFNBO rules, which call for 42% renewable hydrogen usage in the sector by 2030, as well greater incentives for low-carbon hydrogen usage.

Note that currently European countries are asking for an evaluation of the RFNBO DA, not immediate changes to the act itself.

In Q4 2024, a Commission representative commented that it would not change the DA. However, if it were to carry out an expedited assessment of the act, that could potentially open the door to amendments, which is all the more relevant given the challenging scale-up of the hydrogen market.

We previously examined Member States’ hydrogen production projections based on the draft National Energy and Climate Plans (NECPs). Several countries target RFNBO production and consumption by 2025. Combined, they point to a hydrogen demand potential of 419 GWh by 2025, rising to 6.2 TWh by 2030. This pales in comparison to the 2030 10 Mt of domestic hydrogen production ambition (around 394 TWh).

Per Veyt’s assessment, removing the additionality clause would simplify RFNBO production, while at the same time resulting in crowding out, where multiple market actors would compete for the same renewable volumes. The Commission estimates the electricity demand for RFNBO producers at 500 TWh by 2030 to fulfil the target of 10 Mt of domestic production. If renewable hydrogen producers turn to the existing (and growing) RES-E capacity, a wave of demand for RES-E EECS GOs could put upward pressure on the demand curve and prices.

In Veyt’s long-term base-case forecast, demand for renewable GOs from renewable hydrogen producers could drive RES-E EECS GO prices higher by 2030 above the levels currently observed. If new RFNBO demand were to contend with existing demand for renewable capacity, the GO prices could support prices further.

Lifting the restriction on the use of state-supported RES for hydrogen production would require countries such as Germany and Ireland to change their domain protocol rules to allow GO issuance to supported assets which is not currently the case. RES-E GO cancellation is required under all RFNBO production pathways.

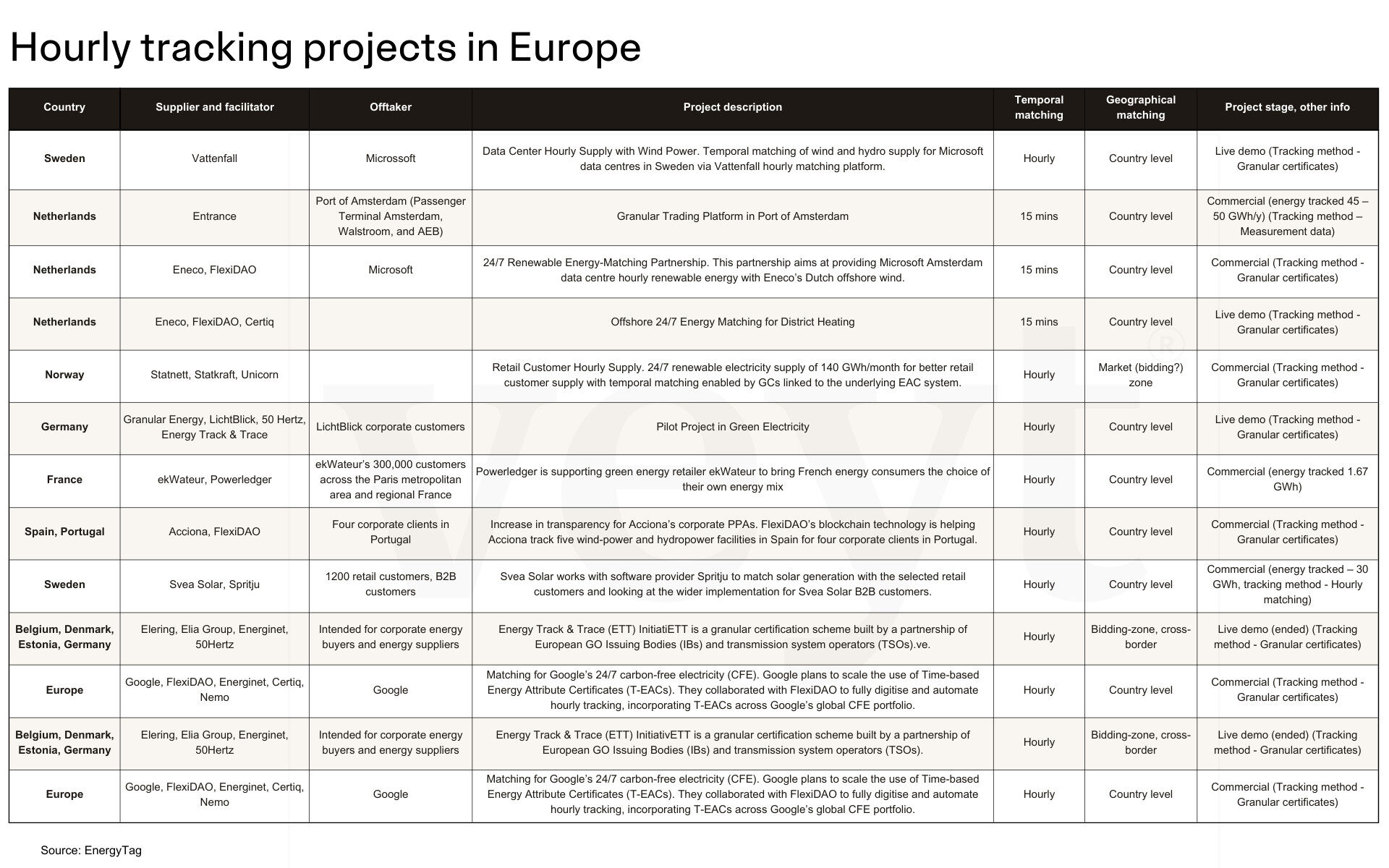

Postponing more granular temporal matching/maintaining monthly matching beyond 2030 would buy GO registries more time to put in place the infrastructure to facilitate hourly matching. It would also delay the hydrogen legislation-induced fragmentation of the GO market where the market for granular GOs and standard GOs could co-exist in parallel, answering different customer demands.

The development of the granular GO market is now at a nascent stage in Europe (see table below).

Currently, there is no clarity on whether geographical matching applies to RES-E GOs i.e. whether they need to be sourced from the same/interconnected bidding zone.

Find out how Veyt can help your company net-zero goals, contact our team contact@veyt.com.

Veyt specialises in data, analysis, and insights for all significant low-carbon markets and renewable energy.