The UK renewable sector faces contrasting trends, with supportive policy measures such as lifting the ban on new onshore wind projects clashing with uncertainty as developers withdraw from flagship offshore wind projects. However, in these changing market conditions, onshore wind has emerged as commercially viable even without government subsidies. Onshore wind and solar projects in certain UK regions can secure higher prices through Power Purchase Agreements (PPAs) than through government-backed Contracts for Difference (CfD). This is particularly true for newly built onshore wind projects in England, which can benefit from higher revenues than similar projects elsewhere.

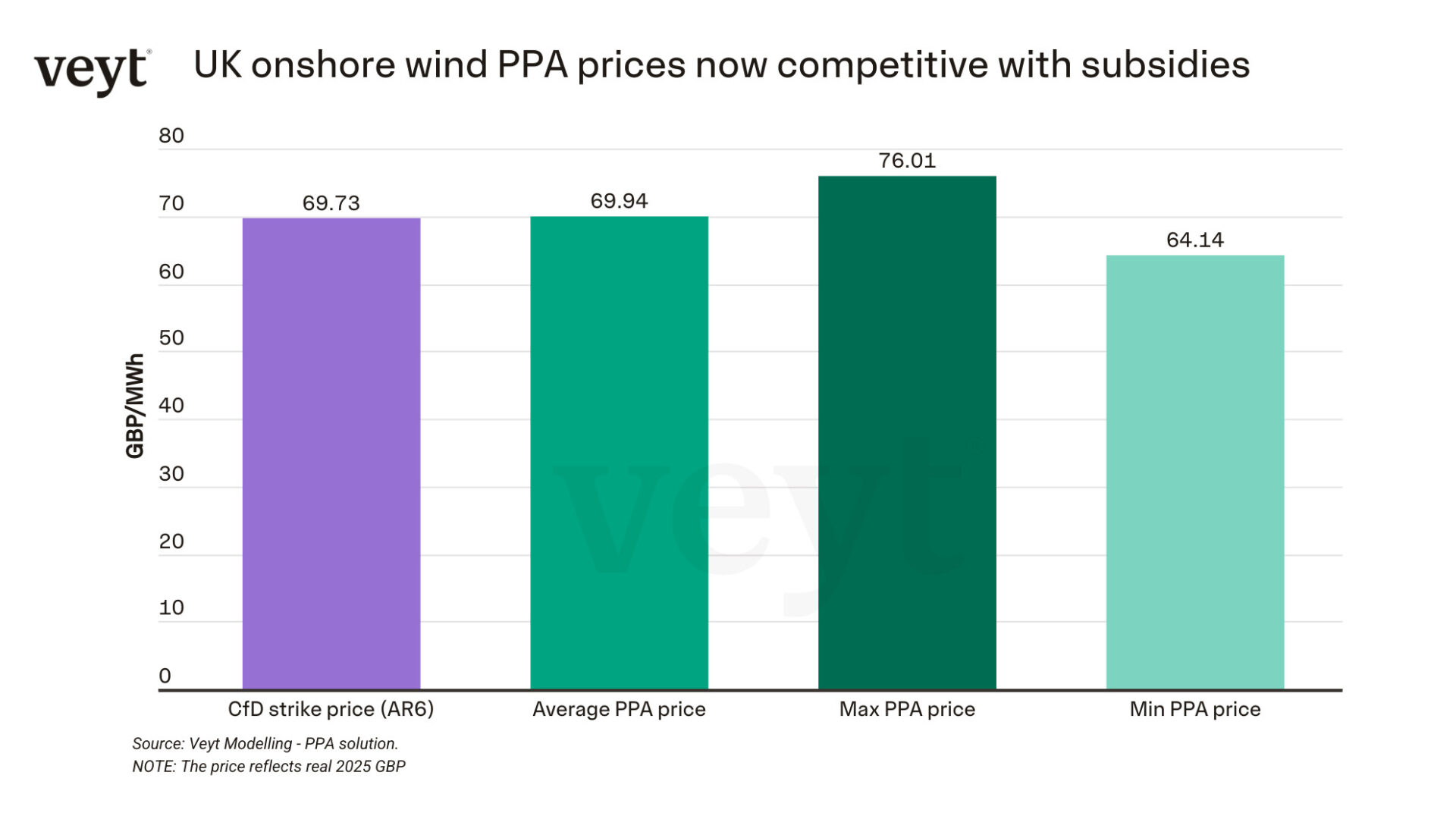

Recent CfD results awarded a price of GBP 69.7 per megawatt-hour (MWh) for onshore wind projects scheduled to come online between 2026 and 2028. PPAs can offer similar or better revenues, with projects along England’s western coast able to secure PPA prices of up to GBP 76.0 per MWh, more than 8% above the national average and 15% above those in Scotland, according to Veyt analysis. The average fair value for a 10-year pay-as-forecast onshore wind PPA across the UK is competitive with CfD at GBP 69.9 per MWh.

A decade-long de facto ban on new onshore wind projects in England was lifted in 2024, opening up fresh project opportunities. Just one small 8 MW project was located in England when last year’s Allocation Round 6 (AR6) awarded contracts to 22 onshore wind projects totalling 990 megawatts (MW). The concentration till now of UK onshore wind assets in Scotland has led to high simultaneity in wind generation and thus significant revenue cannibalisation in the country. In contrast, new projects in England, particularly along the western coast, are experiencing less cannibalisation and benefiting from higher capture rates.

“Lifting the onshore wind ban in England has unlocked significant potential. New sites offer excellent wind conditions, attractive capture rates due to an absence of existing generation, and therefore strong revenues from PPAs. The UK’s ambitious renewable energy targets for 2030 require rapid growth in renewable installations, and both CfDs and PPAs will play critical roles,” said Lisa Zafoschnig, PPA Team Lead at Veyt.

In 2024, the UK PPA market doubled in size compared to 2023, adding more than 2 GW in new agreements. This growth positioned the UK as Europe’s third-largest PPA market after Spain and Poland, driven by a significant route-to-market offshore wind deal and multiple hybrid PPAs. The number of PPAs signed increased to 27 in 2024, up from 20 in 2023. Major corporate buyers included the IT sector (Amazon and data centres), water utilities (Yorkshire Water and Anglian Water), and retail companies (Sainsbury’s, Tesco, and Co-op).’

Many projects under the CfD scheme opt for route-to-market PPAs where developers sign agreements with third parties to manage the projects’ output on the wholesale market. These PPAs often also cover the balancing responsibility for assets, which, according to Veyt modelling, can incur costs of GBP 2-3 per MWh over a ten-year period.

Meanwhile, the offshore wind sector continues to face uncertainty, as Ørsted recently put a 2.4 GW project on hold despite securing a CfD price of GBP 80.7 per MWh in last year’s allocation round. By comparison, the fair value of a 10-year pay-as-forecast offshore wind PPA at GBP 70.4 per MWh is 13% lower. With PPA prices likely falling short of covering high project costs, CfDs remain the more attractive option for offshore wind, offering not only higher revenues but also lower risk, given their 15-year contract duration (which is under discussion for potential extension). Reforms to CfD allocation in AR7 are targeted at ensuring viability and reducing risk for offshore wind projects. If the AR7 auction proves successful for offshore wind projects, more route-to-market PPAs can be expected in the future.

Victor Ponsford,

Responsible, Press Relations at Veyt

victor.ponsford@veyt.com

+47 949 74 977

Veyt specialises in data, analysis, and insights for all significant low-carbon markets and renewable energy.