The European Union is launching EU ETS 2 – a second, parallel carbon market in 2027, with reporting requirements already starting this year. The new system aims to cover fuel combustion emissions from road transport, buildings, and small-scale industry, marking a shift in climate policy across member states and a clear impact on end consumers.

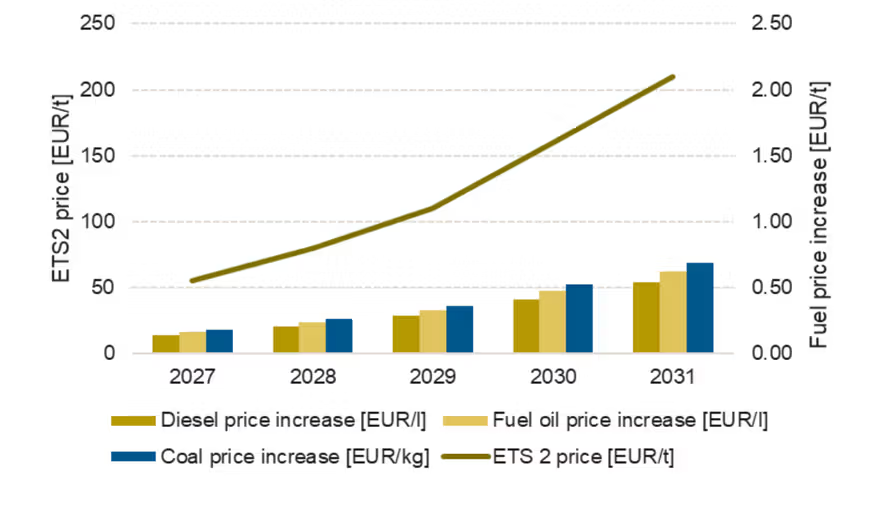

A significant price shift is expected in this new market from a likely starting point of just over EUR 50/t in 2027 to potentially reaching as high as EUR 210/t by 2031, according to Veyt analysis and modelling. This fourfold price increase will be caused by an initial oversupply of allowances in 2027, with a significant undersupply kicking in from 2029.

This should trigger a sizeable wave of emissions abatement equivalent to about 400Mt over all covered sectors by 2040. The cost of abatement will vary across the covered sectors, but the most substantial impact expected is in road transport.

According to Veyt’s analysis, the increase in price for diesel as a result of ETS 2 will be:

Assumptions are tank-to-wheel emissions of 2.56 kg CO2/l diesel, 2.96 kg CO2/l fuel oil, 3.26 kg CO2/kg coal

While ETS 2 is scheduled to start in 2027, a potential one-year delay to 2028 could be introduced depending on oil and gas prices. Unlike the EU ETS, where emissions are assessed at the installation level, ETS 2 places the compliance obligation on fuel providers. Fuel providers – be it oil, coal or gas – will need to buy allowances at auctions because, unlike the EU ETS, no free allowances will be issued.

“Demand for ETS 2 allowances is set to skyrocket in 2029-31. The increase in prices will be felt by any company using coal or gas or any individual using petrol or diesel. ETS 2 is expected to trigger a wave of abatement, while raising further funds for the EU to mitigate the impact of the new market on end consumers,” says Marcus Ferdinand, Chief Analytics Officer, Veyt.

The cap on emissions will be set using 2024 emissions and applying a once-only linear reduction factor (LRF) set at 5.1% of 2024 emissions. This would generate a cap of around 1.05 billion tonnes in 2027 after applying an LRF of 63 Mt, according to Veyt research. However, to increase liquidity in the market at the start, the cap will be frontloaded with 30 per cent in 2027, taken from the auction volume planned for the years 2029 to 2031. Due to this provision, Veyt sees the 2027 amount of allowances reaching the market at 1,367 Mt. This compares to 1,120 Mt of emissions during that year.“This is a similar size as the EU ETS, so Europe is doubling the emissions under a cap as of 2027”, says Ferdinand.

Furthermore, a new MSR (market stability reserve) will be established with 600 million allowances, additional to the cap, to stabilise the market by adjusting auction volumes based on the total number of allowances in circulation. This MSR will reduce auction volumes in case of a large oversupply building up and release allowances in case of market tightness or excessive price moves.

ADDITIONAL NOTES

The SCF is expected to raise 65 bn EUR in total from the auctions of the EU ETS 2 allowances which are to take place during the period 2027-2032 as well as the revenues resulting from auctioning 50m EUAs from within the ETS1 framework and at least 150m allowances from the ETS2 framework. Member States will in addition contribute 25% of their own resources to SCF projects, making a total of “at least” 86.7 billion EUR available for social compensation.

Even though the ETS2 will only start auctioning allowances, the first allocation from the Social Climate Fund (SCF) will be possible already in 2026, one year before the ETS 2 carbon price comes into effect. This is possible as 50m allowances from the ETS 1 will contribute to the SCF build-up, allowances that will be auctioned already in 2025.

Victor Ponsford

Specialising in data, analysis, and insights for all significant low-carbon markets and renewable energy.