Why EU ETS 2 Market Intelligence?

Many market participants struggle to stay ahead of the carbon market and manage their exposure. The challenge isn’t just complexity—it’s the lack of transparency.

Interconnected factors—like macroeconomic trends, European and local policy shifts, fossil fuel prices, and the transition from combustion engines and gas-based heating—make pricing difficult to track and harder to predict.

“Carbon-market forecasting is challenging,” says Ingvild Sørhus, EU Carbon Manager at Veyt. “There are many interdependent factors constantly changing. To tackle this complexity, we’ve assembled a team of specialists and invested in cutting-edge models. Our mission is to provide the trusted data and analysis that every EU ETS participant can rely on.”

Key benefits of Veyt’s EU ETS 2 solution

Veyt’s EU ETS 2 solution equips market participants with the insights and tools needed to navigate the market with speed, clarity, and confidence.

• Time savings: No more scanning countless sources—our experts analyze vast data sets, so you get concise, ready-to-use reports

• Clarity: Complex policy and market changes distilled into clear, digestible reports you can immediately factor into trading or risk-management strategies.

• Confidence: Rely on a consistent stream of expert-driven analysis rather than fragmented public data.

These benefits are valuable now, as the EU ETS 2 market is already taking shape, well ahead of becoming fully operational in 2027. Fuel suppliers exposed to carbon costs can use this solution to evaluate risk, protect margins, and estimate costs more effectively.

Solution highlights:

• Daily price quotes – Changes in EUA2 fair value price assessment through to 2040 – updated daily

• Electricity and fuel price forecasts – Country- level forecasts for electricity, gas, heat oil, diesel

• EU ETS2 allowance price forecasts – Short, medium, and long-term projections to guide trading and risk management

• Market balance report – A detailed breakdown of supply, demand, and surplus/deficit to help time buying and selling decisions

• Market participant behaviour– Insights into demand drivers including financial speculation, compliance and hedging

• Policy updates and expert commentary – Timely insights into EU and member state policy changes.

Veyt EU ETS 2 Market Intelligence Solutions provides price forecasts, market signals, in-depth supply and demand analysis, policy analysis and expert commentary.

Above: Short and long-term price forecasts provide market participants with different perspectives on the market.

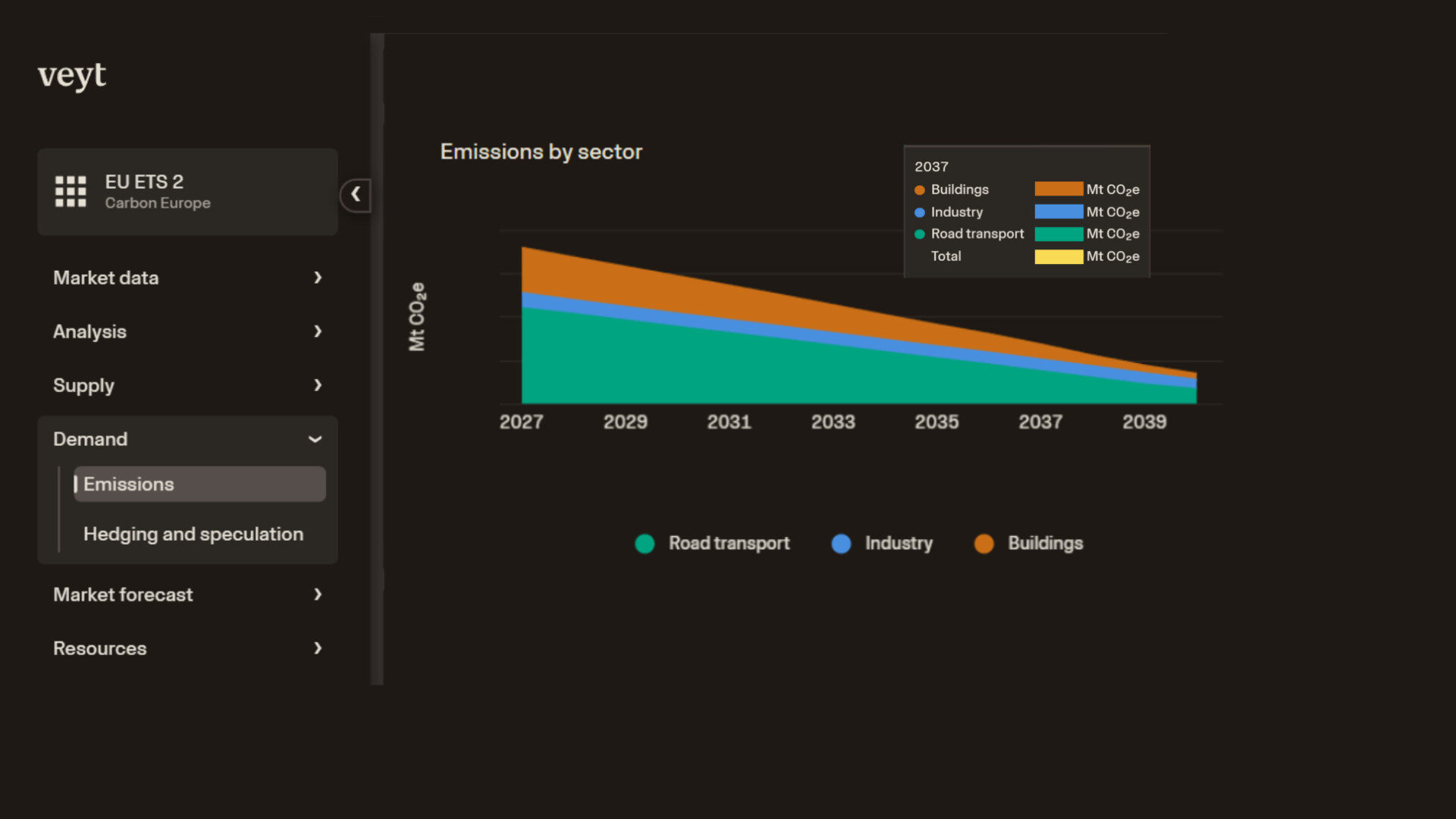

Above: In-depth analysis of supply and demand drivers.

The value of removing market uncertainty

Veyt’s solution reduces uncertainty for market participants by providing data on price drivers, short- and long-term forecasts, and market behavior. Instead of relying on guesswork or outdated information, companies can base decisions on real data and expert interpretation. The result is fewer surprises and stronger input for financial decision-making and planning.

Veyt also supports internal alignment. When all stakeholders—from analysts and traders to executives—share the same baseline view of the market, it’s easier to build a consensus around strategy and respond quickly to changes. Rather than reacting to headlines, teams gain a clearer understanding of the broader market context, enabling more confident planning and action.

Available via a modern web platform

The EU ETS2 solution is available to subscribers via a modern, online platform. Subscribers can also access analysis about other renewable energy and carbon markets in the same place.

Ready to See It in Action?

Book a live demo today to explore how Veyt’s EU ETS 2 solution can support your businesses carbon market analysis, trading, compliance, and risk management strategies.

Looking for up-to-date EU ETS2 Market Outlook? Subscribe to receive our latest analyst update

Veyt specialises in data, analysis, and insights for all significant low-carbon markets and renewable energy.