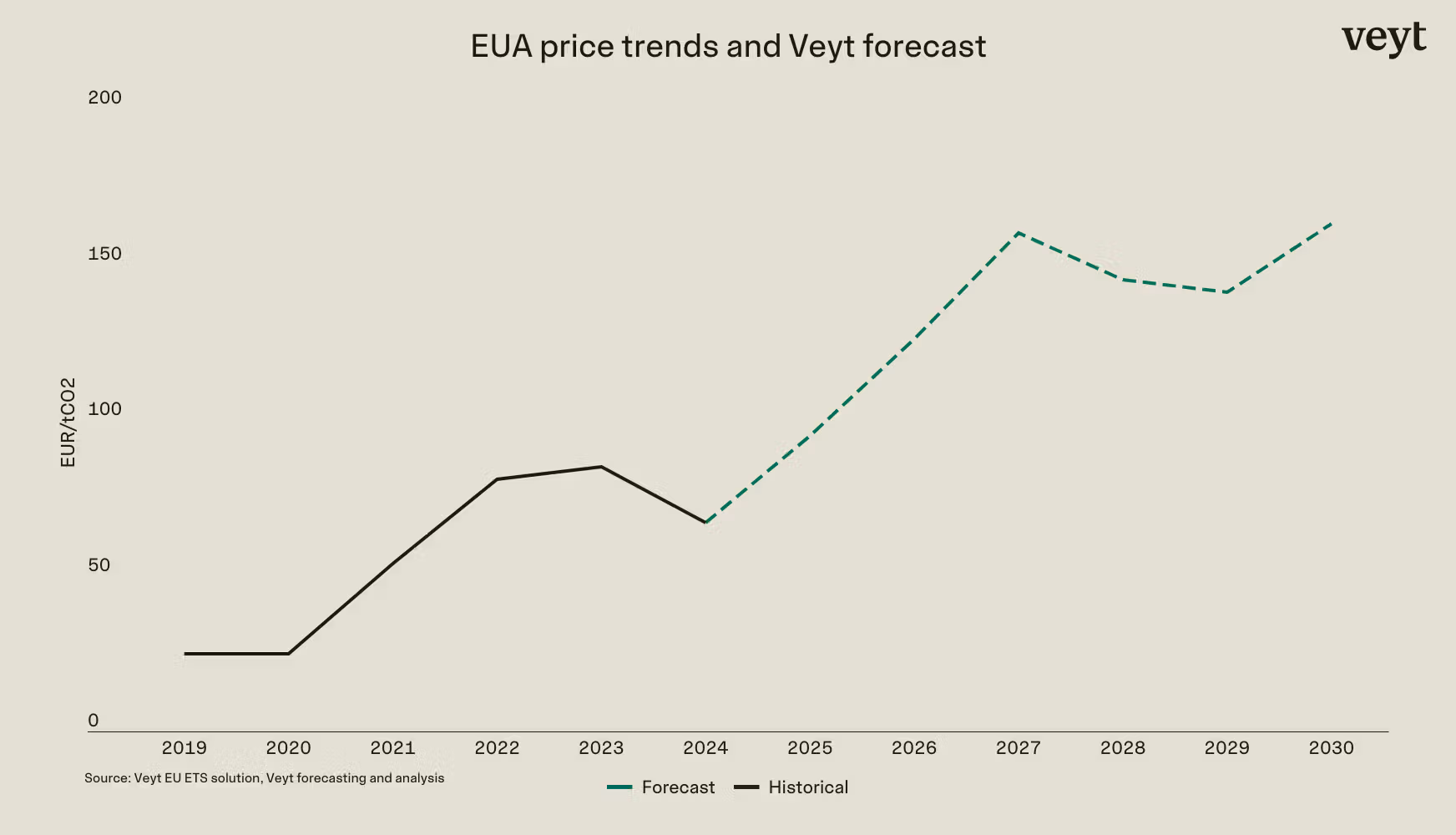

Starting in 2026, the market balance will begin to tighten significantly. We expect market participants to increasingly turn their attention to the upcoming supply squeeze in the market. Amidst the overall fit for 55 framework that reduces supply of fresh allowances, the Market Stability Reserve (MSR) continues to eat into the remaining market surplus. This market balancing tool will work with accelerated pace in the coming years to account for the additional volumes of EUAs put on the market over 2023-2026 to finance the REPowerEU programme.

By 2027, the market is likely to face a severe supply squeeze, with the cumulative effect of these measures exacerbating the scarcity of allowances.With a structural phase-out of fossil generation in the European mix and rapidly decreasing power sector emissions, the responsibility to ensure that emissions stay below an ever-shrinking cap will fall on industry sectors. Abatement costs in industry will increasingly become the price setting factor for EUA prices.

“Market participants must soon lift their gaze from the near term and reassess their core assumptions. Current prices fail to fully reflect the tough dilemma emitters will face: competing for a shrinking pool of EUAs, implementing costly abatement technology, or scaling down production. While it’s difficult to predict when consensus will emerge, time is fast running out, as 2025 marks the final year before the ‘great squeeze’ begins.”, says Hæge Fjellheim, Head of Carbon, Veyt

Veyt specialises in data, analysis, and insights for all significant low-carbon markets and renewable energy.