Germany operates 61 GW onshore wind, 79 GW solar and 8.5 GW offshore wind capacity. The majority of these plants receive incentives via the EEG (Renewable Energy Sources Act) support scheme . However, some 2.5 GW of German onshore wind installations have started 2024 outside the EEG support scheme as their incentive contracts have ended. This brings the total onshore wind capacity that operates on a market basis to 10.3 GW or almost 17% of total installed capacity. Weaker and more volatile wholesale electricity prices combined with bearish guarantees of origin (GOs) prices may push those installations to sign PPAs (power purchase agreements) rather than hedge their production directly on the market.

The average German day-ahead baseload price fell to EUR 95.18/MWh in 2023 compared to EUR 235.45/MWh in 2022. Additionally, Germany experienced a record 301 hours with negative prices last year, up from 69 hours in 2022. This trend is likely to intensify this year. This has reduced the profitability of renewable generators on the market.

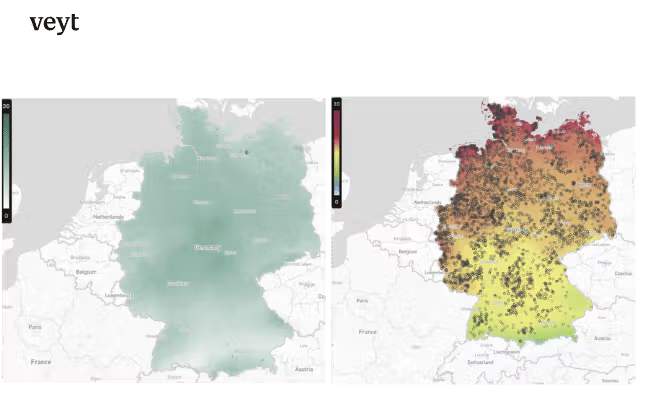

Generally, areas with little existing wind build-out see lower capture cost, while areas with large density of existing installations experience higher capture cost. The capture cost reflects the discount compared to the base price due to renewable assets’ volatile generation profile.

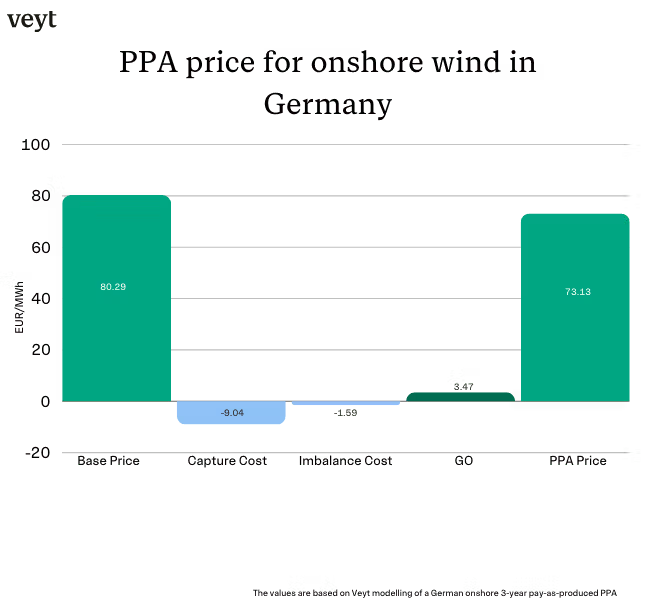

This is reflected in the fair value of the final PPA price. For example, a three-year pay-as-produced PPA starting in 2025 at a wind farm close to Hanover can achieve a price of EUR 76.57/MWh, while a plant close to Bodensee could get EUR 67.72/MWh. To compare, the average onshore wind PPA price for Germany would be EUR 73.13/MWh, according to Veyt modelling.

“The emerging picture in Germany demonstrates the challenges of the energy transition for both policy makers and producers. On its own the government’s EEG support scheme is unlikely to help the country meet its ambitious 2030 renewables targets. Private sector action through market instruments such as PPAs (power purchase agreements) will be key by lifting new investments and keeping older generators operational for longer. A deep understanding of the main PPA value drivers, and how they vary from north to south in Germany is crucial when embarking on the complex journey of PPA negotiations,” says Irina Peltegova, Senior Analyst, Renewable Power.

The volume-weighted annual average price achieved on the market by onshore wind generators stood at EUR 76.20/MWh last year with the price dropping to EUR 50/MWh in December 2023 for the first time since spring 2021, according to Deutsche WindGuard data.

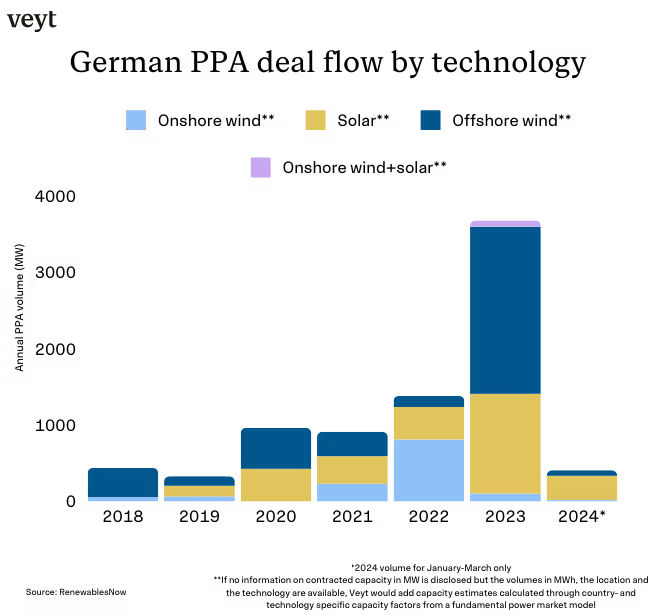

2023 was pivotal for Germany’s PPA market with a record total of 3.7 GW worth of new PPAs reported. Nevertheless, solar and offshore wind have been dominating the market with onshore wind PPAs representing just 3% of the total contracted capacity last year after a very strong 2022 when the technology saw over 800 MW contracted under PPAs (58.5% share). Between 1 January and 31 March 2024, a total of 12 PPAs have been announced in the country. Of these, only two were for onshore wind and another two were hybrid PPAs including onshore wind and solar.

Capture costs vary greatly geographically depending on local wind resources and the correlation of resulting generation with the overall generation in Germany.

The difference between the minimum and maximum capture cost for onshore wind in Germany can be up to EUR 8.79/MWh for a 3-year pay-as-produced PPA starting 2025, Veyt modelling reveals. Furthermore, the same PPA’s balancing cost can vary by up to EUR 1.34/MWh depending on the grid zone the installation is based in. Understanding the fair value of the various PPA pricing components and choosing the right location to sign a PPA in Germany is key to securing the best outcome for both counterparties.

Map 1: location specific capture cost for a 3-year pay-as-produced PPA starting 2025 based on Veyt modelling. Map 2: Average wind speed 2013-2022 at 100 m above ground and location of existing onshore wind assets in Germany

Victor Ponsford,

Veyt specialises in data, analysis, and insights for all significant low-carbon markets and renewable energy.