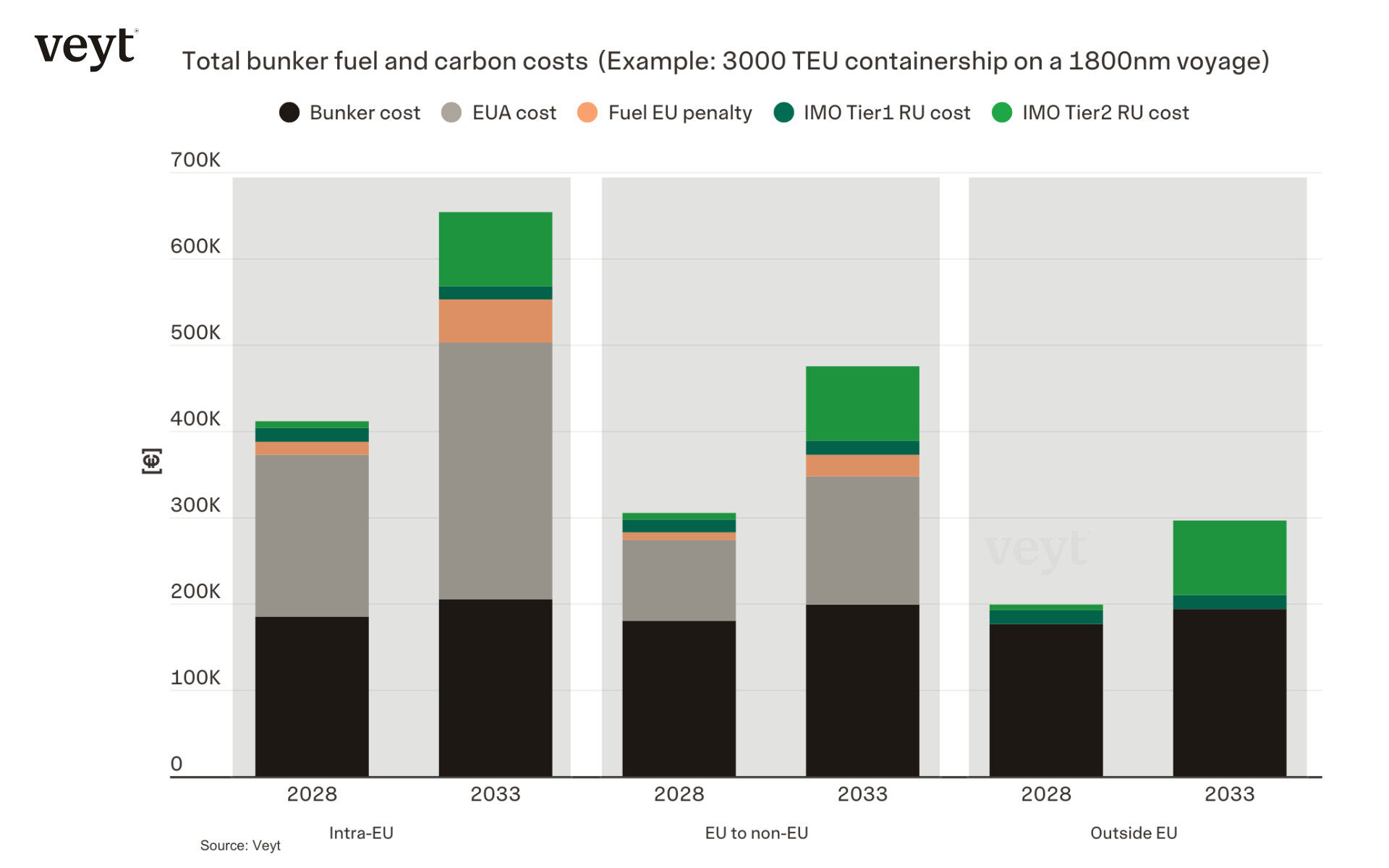

Global shipping is set to see the total carbon cost associated with fossil fuels double or triple by 2033, with intra-EU routes facing the sharpest increases. This escalation will be driven by three new regulations that seek to bring down shipping’s 3% contribution to global greenhouse gas emissions: the EU Emissions Trading System (ETS), the FuelEU Maritime Regulation, and the forthcoming Net-zero Framework of the International Maritime Organization (IMO). European shipping will bear the biggest burden and, with it being home to some of the world’s busiest shipping lanes—including the English Channel—shippers must move quickly to comply with stricter carbon regulations or face significant financial penalties.

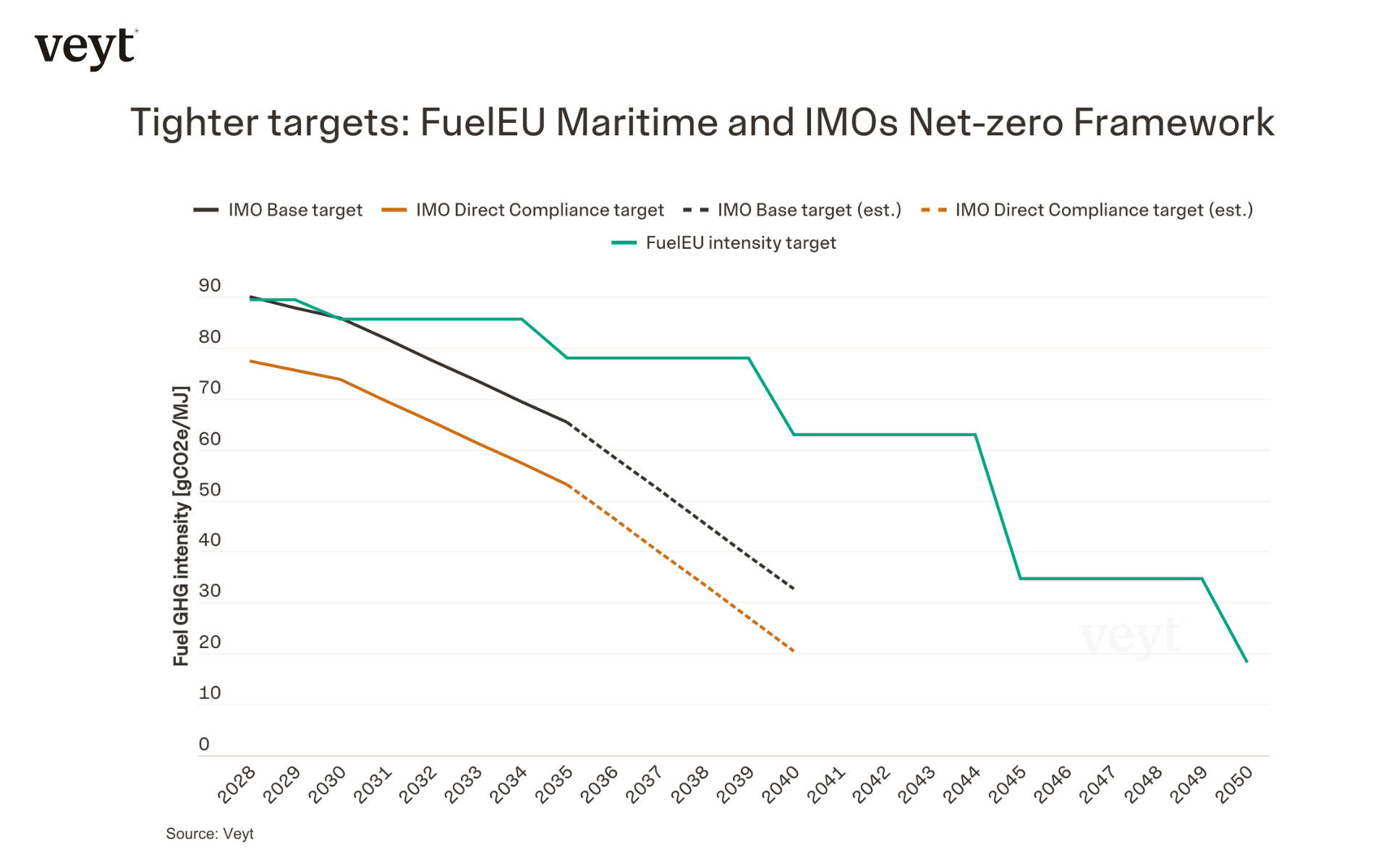

Beyond Europe, Veyt analysis shows that across all major shipping routes bunker fuel and GHG regulatory costs will rise sharply between 2028 and 2033. The increase will be driven primarily by the IMO’s planned Net-zero Framework, taking effect in 2027, that will introduce progressively tighter GHG intensity targets. The IMO targets will tighten more rapidly than those of FuelEU Maritime, though with different penalties. Consequently, vessels compliant with FuelEU Maritime through 2030 may still fall short of IMO’s stricter targets, including liquefied natural gas (LNG)-powered vessels. To minimise overlapping regulations, the European Commission will review—and may amend—EU regulations following the IMO’s formal adoption of its Net-zero Framework in October 2025.

The EU ETS costs for intra-EU voyages could match bunker fuel costs as early as 2028. According to Veyt’s research, EUA price will reach 271 €/t in 2033, and by then the EU ETS costs alone could account for nearly a third of total fuel-related costs for EU to non-EU routes.

While voyages outside the EU will be less affected, global IMO measures are still expected to raise costs by around 30–35% by 2033. These rising costs will create strong financial incentives for shipping companies to boost fuel efficiency and adopt lower-emission fuels.

Some relief may arrive as the European Commission intent to review EU maritime climate policy following the IMO’s expected adoption of the Net-zero Framework. Both the EU ETS and FuelEU Maritime include provisions to assess potential alignment with international measures, aiming to avoid regulatory overlap and ensure consistency with the Paris Agreement. How and when alignment may occur is uncertain.

“Proactive shippers are already looking at how to best decarbonise their operations—whether through active carbon allowance strategies, investment in low-carbon shipping technologies, or a combination of both. For shippers that were uncertain whether emission regulations would materialise, the new IMO rules go even further than the EU in some respects and send a clear signal that all regions and routes will be affected. European shippers, in particular, will be hoping that their steeper timeline leaves their lower greenhouse-gas intensity vessels well positioned to offer more competitive rates on the global stage over time,” commented Frank Melum, Senior Analyst in Maritime Carbon at Veyt.

Source: Veyt’s Maritime Fuels solution.

The EU ETS and FuelEU Maritime regulations are central to Europe’s maritime decarbonisation strategy. The EU ETS, which covers 100% of intra-EU emissions and 50% from international voyages involving the EU, imposes a direct carbon price on shipping—encouraging measures like slow steaming, fuel switching, and technical upgrades. FuelEU Maritime, in force since January 2025, sets a tightening cap on the GHG intensity of onboard energy use (green line in figure above), with flexibility through fleet-wide compliance pooling. Current non-compliance penalties of €2,400 per tonne VLSFO energy equivalent are set to become stricter post-2035

The IMO Net-zero Framework will introduce global GHG intensity limits. Its two-tiered emissions compliance system will require vessels exceeding the Direct Compliance Target (Tier 1) (orange line in figure above) to purchase lower-cost Remedial Units (RUs), while those exceeding the less strict Base Target (Tier 2) (black line in figure above) as well must purchase higher-cost RUs for these emissions. Ships with emissions below the Direct Compliance Target will be eligible for Surplus Units (SUs). Ships with emissions above the Base Target will be able to purchase Surplus Units (SUs), which can be banked for up to two years. IMO targets will tighten faster than FuelEU Maritime’s, though the regulatory landscape beyond 2035 remains under negotiation (estimates shown at dotted lines from 2035 to 2040).

Taken together, the coming decade will see global shipping under unprecedented pressure to cut emissions and transition to cleaner energy. The combined impact of carbon pricing, fuel intensity standards, and evolving international regulations will shape investment, technology adoption, and operational strategy across the sector.

Notably, many vessels powered by LNG—often seen as a transitional fuel—may remain compliant with FuelEU Maritime targets through 2030, but face deficits under the IMO Framework’s tougher Tier 1, and later Tier2, thresholds. This underscores the increasing complexity of maritime regulation, where compliance with one framework may not ensure alignment with another.

Looking ahead, Veyt modelling suggests that by 2033, EU ETS costs alone could match or exceed bunker fuel costs on intra-EU routes, and contribute nearly a third of total voyage costs on EU–non-EU routes. Even voyages entirely outside the EU, while shielded from EU regulations, will face around 30–35% cost increases as the IMO Framework is phased in.

Source: Veyt’s Maritime Fuels solution.

Victor Ponsford,

Responsible, Press Relations at Veyt

victor.ponsford@veyt.com

+47 949 74 977

Veyt specialises in data, analysis, and insights for all significant low-carbon markets and renewable energy.