Italy’s Energy Release scheme, valued at nearly €4.5 billion over three years, was designed to offer energy-intensive industries access to low-cost renewable electricity. The scheme has now been suspended following a European Commission investigation into potential breaches of EU state aid rules. Under the plan, companies would have received 23 terawatt-hours (TWh) of renewable electricity per year at a fixed price of €65 per megawatt-hour (MWh) for three years. In exchange, participants would commit to producing or contracting double that amount over 20 years through on-site generation or long-term power purchase agreements (PPAs). This attractive prospect meant the initiative was oversubscribed nearly threefold. However, it was put on hold before contracts could be awarded.

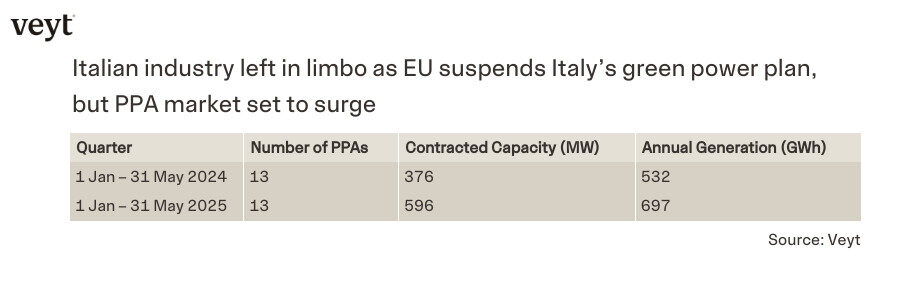

Once the scheme gets the green light, PPA demand is expected to boom, with solar and onshore wind projects likely to be the primary beneficiaries. Italy’s PPA market has already seen a boost, ranking as the third largest in Europe by contracted capacity in the first five months of 2025, according to Veyt data. Utilities, IT and telecoms have been driving the demand so far this year, but industrials should follow soon.

Mary Polovtseva, Renewable Energy Policy Analyst at Veyt, said:

“The Energy Release scheme was always more than a subsidy. It was a structural bet on long-term industrial decarbonisation and market-based renewable contracting. Even as the regulatory process plays out, we expect its impact to start taking shape in the PPA market, where demand is up, interest is growing, and companies are starting to think collaboratively about scale.”

The scheme attracted 559 applications covering more than 70 TWh of annual demand from over 3,400 industrial electricity consumers. It was expected that the overwhelming majority would be approved, but the Commission’s investigation has brought the process to a halt.

At the heart of the EU’s concern is whether offering renewable electricity below market prices constitutes illegal state aid. Italy already operates two support mechanisms for industrial consumers: one to compensate for indirect emissions costs from the European carbon market (EU ETS) and the other to reduce electricity levies. The Energy Release scheme would have layered additional benefits on top, raising the risk of overcompensation.

The Commission is also reviewing Germany’s proposal to subsidise electricity prices for energy-intensive industry. Unlike the Italian model, the German plan does not require any renewable generation commitments from participating firms.

The suspension of the scheme has introduced fresh uncertainty into the market for renewable energy certificates in Italy. These certificates, known as Guarantees of Origin (GOs), are sold in scheduled auctions by the national energy agency GSE. The last auction, held on 20 June 2025, offered GOs from production year 2024 only. This means that, for now, no volumes previously set aside for the Energy Release scheme have yet been redirected to the open market, as the scheme covers renewable production from 2025 onwards.

The scheme was expected to reduce demand for certificates from industry, as companies would receive the required documentation alongside their subsidised electricity. However, it remains unclear whether companies would have been allowed to combine the Energy Release scheme with other forms of support — a legal grey area that may now be addressed through the EU probe.

Despite the current pause, longer-term demand for renewable electricity and certificates is growing. Consumption of renewable energy certificates in Italy rose by 23 percent last year, reaching 113.7 TWh. Much of this was driven by companies complying with renewable sourcing requirements attached to existing financial support schemes and sustainability reporting obligations.

Beyond the immediate impact, the scheme was designed to trigger long-term investment in new renewable capacity. Participants were expected to return at least 138 TWh of renewable electricity over 20 years, either through their own generation or by signing long-term PPAs.

PPAs can be a cost-effective way of returning the electricity received at a reduced price. The cheapest option, according to Veyt modelling, is a pay-as-produced solar PPA with a fair value of EUR 72.6/MWh over 10 years. While this is. higher than the discounted electricity price, it remains significantly below the cost of baseload electricity delivery.

However, most individual allocations would have been relatively small. On average, each beneficiary would have received around 7.7 gigawatt-hours annually, creating an obligation to produce 2.3 GWh per year, which is far below the scale of a typical utility-scale project. For comparison, utility-scale solar PPAs in Italy averaged 40.6 MW and 55 GWh of annual output in 2024, while onshore wind PPAs averaged 28 MW and 62 GWh. This mismatch means that most companies would need to form buyer consortia or join aggregated procurement platforms to access viable projects.

While the Commission’s ruling will determine the future of the scheme, its ripple effects are already reshaping Italy’s renewables landscape. The pause may delay near-term support for industry, but the underlying market momentum from growing PPA appetite to structural demand for GOs is unlikely to reverse.

For additional information, please contact:

Victor Ponsford

Responsible, Press Relations at Veyt

victor.ponsford@veyt.com

+47 949 74 977

Specialising in data, analysis, and insights for all significant low-carbon markets and renewable energy.