US carbon markets have entered a period of heightened uncertainty and volatility, with tariffs and rising power sector emissions expected to drive up allowance prices. Just as significant is the US exit from the Paris Agreement, which eliminated key federal climate commitments. Inflation Reduction Act (IRA) subsidies—critical to the country’s decarbonization efforts—are also under review.

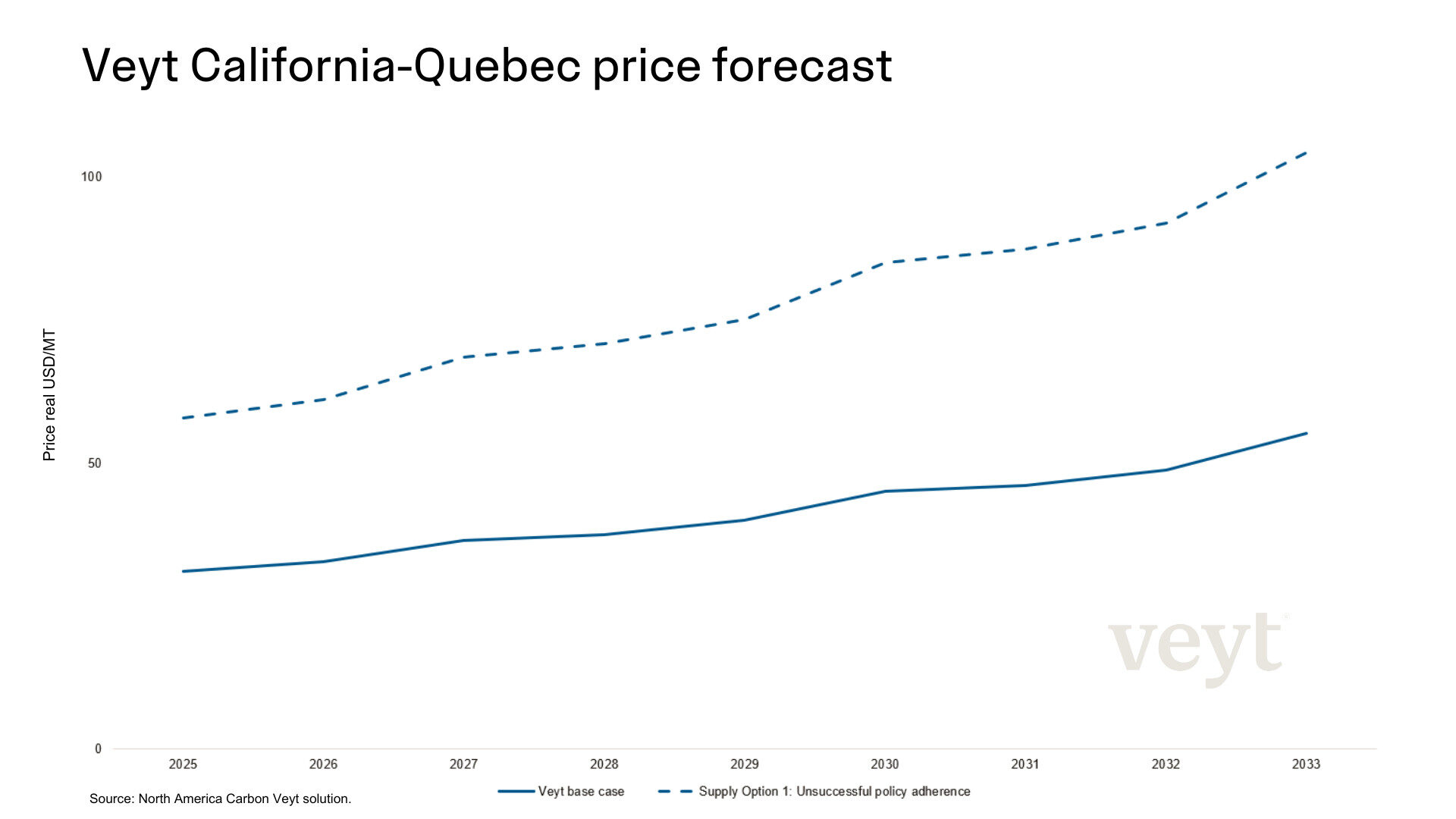

From surging energy demand driven by the tech sector to the rollback of electric vehicle incentives and the potential reshoring of tariffed industries, US emissions are poised to rise. With the federal government doubling down on fossil fuel production and scaling back climate initiatives, the spotlight now falls on the 10 RGGI states and California. If these jurisdictions maintain ambitious emissions caps, allowance prices are likely to climb—California Carbon Allowance (CCA) prices could surpass $80/ton by 2030, around $30 higher than scenarios in which IRA support remains intact and EV scaleup progresses, according to Veyt modelling.

Adding to the uncertainty is the complex and shifting tariff dynamic between the US and Canada. While the Trump administration pushes a ‘drill, baby, drill’ agenda, Canadian hydropower remains a clean, reliable, and low-cost energy source—particularly important for downstream industries like aluminum, which depend on stable baseload power. US tariffs on electricity, aluminum and other imports risk disrupting this value chain. Replicating such production domestically would be both costly and carbon-intensive. Doing so would also fail to address the scale of clean energy already flowing south most of which is used in key sectors or households: Canadian hydropower accounts for up to 10% of Massachusetts’ electricity consumption and supplies up to 15% of New York’s grid—critical to the state’s 70% renewable energy target for 2030. Undermining this supply through tariffs risks higher emissions from fossil generation in RGGI states, adding upward pressure on allowance prices.

“With federal climate policy in retreat and emissions set to rise, the burden of climate action now falls squarely on state-level markets. If RGGI and WCI hold their line with ambitious caps, we’re looking at the most bullish conditions for North American carbon prices ever.” – Luke Sideropoulos, North American Carbon Analyst

At the heart of the pricing dynamic is the future of the Inflation Reduction Act. The landmark legislation had previously helped suppress emissions by accelerating clean energy buildout and electric vehicle uptake, particularly in California and RGGI states with ambitious renewable targets. If its core provisions are dismantled, decarbonization will slow—and demand for carbon allowances will rise. In California’s transport sector alone, the rollback of EV incentives could significantly impact progress toward its 100% zero-emission vehicle sales goal by 2035, with emissions remaining elevated well into the next decade.

Crucially, whether carbon prices actually rise depends on whether regulators maintain stringent supply caps. Both WCI and RGGI are currently undergoing reform processes—California’s Air Resources Board (CARB) is finalizing its Initial Statement of Reasons (ISOR), while RGGI regulators are preparing a revised Model Rule. In both cases, there are signs of hesitation as states weigh political sensitivities around rising power and fuel costs. Ambitious targets could support strong price signals and emissions reductions; weaker caps risk undermining the very function of these markets.

So far, the markets have remained relatively stable. RGGI futures are up 5% since February, while CCA futures have fallen just 1% in the same period. This suggests participants are cautiously monitoring regulatory developments and waiting for clearer signals on future cap trajectories. With allowance demand likely to rise in the medium term, the question now is whether regulators will rise to meet the moment—or temper ambition in response to short-term political pressure.

But the stakes extend beyond near-term market volatility. These carbon markets are not only compliance tools—they are also financial engines for the energy transition. Revenue generated through carbon markets like RGGI and WCI plays a critical role in supporting decarbonization efforts across participating jurisdictions. These funds are typically reinvested in energy efficiency, grid modernization, and the development of low-carbon technologies. While increased domestic oil and gas production may address short-term energy needs, it does not provide a sustainable alternative to clean, domestically sourced power. In contrast, China has demonstrated the ability to rapidly scale renewable capacity, expand grid infrastructure, and dominate global EV production—now accounting for the majority of EVs sold worldwide. Without consistent federal support and strategic investment, the US risks ceding leadership in key industries of the net-zero economy.

As the US federal government retreats from climate leadership, the role of state-level carbon markets becomes even more consequential—not just for emissions trajectories, but for the country’s broader economic positioning. The decisions regulators make in the coming months will determine whether carbon pricing continues to drive meaningful decarbonization. With global competitors accelerating their clean energy transitions, North America’s carbon markets may prove to be one of the last remaining levers for climate progress—and a test of whether the US still intends to lead in the industries of the future.

Victor Ponsford,

Responsible, Press Relations at Veyt

victor.ponsford@veyt.com

+47 949 74 977

Specialising in data, analysis, and insights for all significant low-carbon markets and renewable energy.