The German government laid the foundations of a national hydrogen network on Monday through the award of a EUR 4.6 billion funding package to the developers of 23 hydrogen production, transmission and storage projects.

The individual commitments were unveiled by German economy and climate minister Robert Habeck and formalised support to projects identified on 15 February as part of the Hy2Infra wave of the Important Projects of Common European Interest (IPCEI) package.

In summary, Germany’s Hy2Use support scheme covers:

The 22 projects with confirmed support therefore received a subsidy of EUR 3.4 billion, leaving a EUR 1.2 billion discrepancy with the total EUR 4.6 million announced by the economy and climate ministry (BMWK). The outstanding project was ‘AquaDuctus’, an offshore hydrogen pipeline which would connect the port of Wilhelmshaven to supply projects in the North Sea, whose allocation would be confirmed shortly, the state government of Lower Saxony confirmed in a separate release on Monday.

Pending the final award, the largest individual grant was the EUR 492 million, made to Essen-based energy giant RWE’s 300MW ‘GET H2 Nukleus’ project in Lingen, western German, with the largest pipeline network grant awarded to Leipzig-based utility VNG’s transmission subsidiary ONTRAS for the 618km ‘doing hydrogen’ scheme (See Figure 1).

The IPCEI programme effectively exempts decarbonisation projects from State Aid rules, although funds must still be sourced from member states. Part of the funding would be secured through the German Recovery and Resilience Plan (DARP), the BMWK confirmed. Under the country’s hydrogen funding formula, 30 per cent of the funding was drawn from state governments with the 70 per cent balance provided by the federal government.

The award is the latest in a spate of announcements by the German government to inject momentum into the creation of a core hydrogen production and transmission network.

After the IPCEI support, private proponents would contribute the EUR 3.3 billion balance of funding, implying an average public contribution of 58 per cent across the 23 projects.

The implied subsidy for the nine electrolyser projects ranged from EUR 1,208 to 2,000 per kilowatt of capacity with an average EUR 1,448. However, this metric does not account for differences in scope between projects.

As for infrastructure projects, pipelines would be supported by an average EUR 0.79 million per kilometre, while storage assets received an average EUR 2.8 million per million cubic metre. The pipeline schemes would also be eligible for a EUR 3 billion package of loan guarantees, allowing access to funding below market rates from state bank KfW, in an arrangement cleared by the European Commission on 24 June.

The level of support marks a step change to earlier hydrogen projects in Germany, which have faced challenges with financing and material cost inflation. The Bad Lauchstädt Energy Park, an integrated electrolyser and transmission project which took an investment decision in June 2023, received EUR 34 million on a project cost which surged 50 per cent against the original budget to EUR 210 million.

The direct funding is part of a wider package of measures intended to derisk private sector involvement in the hydrogen sector. On 21 June, the German government proposed a draft Hydrogen Policy Acceleration Act, designed to speed regulatory approvals for key hydrogen infrastructure projects.

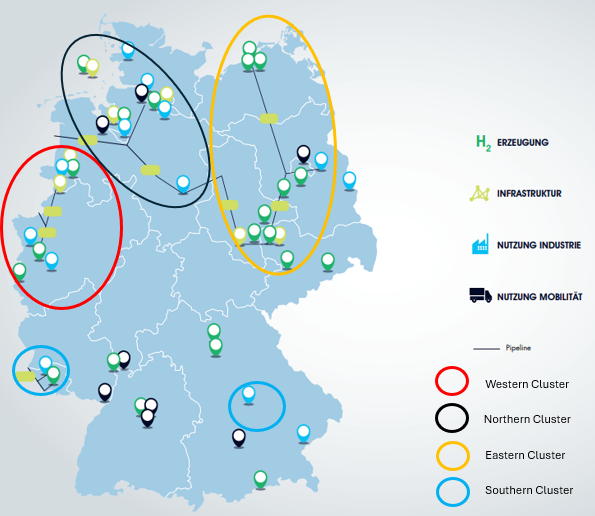

The project awards were presented by the economy and climate action ministry (BMKW) as representing four clusters, grouped either through the concentration of energy-intensive users or through proximity to connecting pipelines from neighbouring countries.

These consist of:

Figure 2: German hydorgen project clusters against IPCEI schemes (BMWK 2021/ Veyt)

Of the four groupings, the northern cluster is likely to play a pivotal role in the immediate shaping of Germany’s hydrogen industry.

On the demand side, the region hosts a trio of major steel facilities, two Arcelor Mittal plants at Hamburg and Bremen, and the SALCOS plant at Salzgitter, which have secured a combined EUR 2.35 billion to decarbonise steelmaking predominantly through Direct Reduction of Iron units fed by renewable hydrogen. Arcelor Mittal’s Bremen plant signed an MoU in January to purchase hydrogen from EWE’s 320MW Emden electrolyser, which forms part of the regional utility’s IPCEI award.

The funding confirmed the cluster’s greater importance as a gateway to link international suppliers to deeper pockets of demand further inland. In addition to hosting a number of ammonia import proposals, the region would be connected to the Netherlands, and ultimately Denmark, via the 407km German leg of Dutch TSO Gasunie’s ‘HyPerlink’ network, which received EUR 145 million in IPCEI funds.

The confirmation of IPCEI status for the ‘AquaDuctus’ project also raises possibility of connection to supplies from Germany’s North Sea neighbours. The project, which is composed of a 203km offshore and 92km onshore pipeline, was originally intended to connect up to 10GW of electrolysers supplied by the SEN-1 offshore wind area around the North Sea island of Heligoland. However, the pilot production phase of the so- called ‘Aquaventus’ project was dropped from the funding round.

The ongoing negotiations around ‘AquaDuctus’, which was expected to cost EUR 1.6bn in a feasibility study completed in March 2022, opens the possibility about a remodelled role in a wider North Sea network. A separate study by Norwegian TSO Gassco and German agency DENA in November 2023 mooted a connection to AquaDuctus as a possible approach to transporting up to 4 million tonnes of hydrogen from Kollsnes to Germany via a 845km pipeline.

Domestically, the northern cluster would be directly linked to its eastern counterpart via a southern spur of ‘HyPerlink’ which connects to ONTRAS’ 301km ‘Green Octopus Central Germany’ network which continues southeast as far as the city of Leipzig. The TSO would also connect to ammonia import and production projects at the port of Rostock via the ‘doing hydrogen’ pipeline. Key potential offtakers in the cluster would include TotalEnergies Leuna refinery, the PCK Refinery at Schwedt and the SKW Piesteritz ammonia plant, which all have hydrogen use projects at various stages of maturity.

The western cluster, which would also enjoy cross-border infrastructure with the Netherlands, aggregates demand from large-scale refining, steel and chemicals projects in the northern Rhine and Ruhr valleys.

While the division into clusters allowed the BMWK present a balanced view of regional spending, they could not disguise the relative strategic importance of the country’s northwestern region. The state of Lower Saxony, which straddles the northern and western groupings, attracted EUR 1.28 billion, or 30 per cent of the funding, with the number set to rise significantly when the AquaDuctus grant is announced. Energy minister Christian Meyer presented the state as, ‘the future hub for the import and distribution of green hydrogen in Germany’, in the regional government’s statement.

On a political level, both the funding award and the slew of recent supporting policy measures to ease planning and underpin demand, demonstrate a government pulling all available policy levers to seed a hydrogen industry on a globally-competitive scale.

The final IPCEI project subsidies were awarded ten days after Germany’s coalition government agreed a 2025 budget which Chancellor Olaf Scholz described as containing ‘record’ clean energy investments. This represents a reiteration of the coalition government’s clean energy commitment eight months after the Constitution Court ruled out the government’s intended plan to deploy recovery funds for clean energy investments.

Overall, the groundbreaking level of support displays a recognition of the scale of intervention required to secure co-ordinated action across Germany’s patchwork of network operators, including the nine which received funding in the Hy2Wave IPCEI round.

This includes the afore-mentioned KfW loan guarantees to network operators but also measures to assure long-term offtake. In addition to funding packages to switching from heavy industries such as steel, the BMWK tendered earlier in July for 7 GW of ‘hydrogen-ready’ power plant capacity with a further 500 MW of pure hydrogen peaking plant.

On the domestic production side, there may be questions as to whether the EUR 2.08 billion allocated to achieve 14 per cent of Germany’s 10GW electrolyser target by 2030, would represent a sustainable level of support

should manufacturers fail to achieve expected efficiencies towards the end of the decade.

This question would be sharpened by concerns around German industrial competitiveness reflected in the coalition’s poor European election showing, leading Habeck to present the IPCEI awards as ‘creat[ing] the conditions for climate-neutral growth’.

If not, domestic production costs may compare unfavourably with prices equivalent to EUR 4.50 per kilogram price implied by the recent H2Global auction, which BMKW described as beating internal estimates. The German government has committed to a further EUR 3.5 billion of imports using the scheme with EUR 300 million allocated to a joint auction with the Netherlands.

Despite the high level of support to winning projects, a number of domestic electrolysis projects which were included in the original IPCEI submission drafted in 2021, including not only ‘Aquaventus’ but those proposed by Linde and Total at Leuna and EDL at Leipzig, failed to secure funding in this round. By contrast, the announcement confirmed support for every transmission and storage project included in Germany’s original IPCEI plan.

In a 2023 update to its Hydrogen Strategy, the BMKW announced that up to 70 per cent of Germany’s hydrogen consumption by 2030 would be covered by imports and countenanced the use of CCS-enabled fossil hydrogen, including by pipeline from country’s including Norway.

Confirmation of the precise role of AquaDuctus, which will be able to supply domestically produced hydrogen from the North Sea as well as to connect to potential Norwegian supplies, will be instructive in demonstrating the government’s stance toward the future balance between domestic production and imports.

Veyt specialises in data, analysis, and insights for all significant low-carbon markets and renewable energy.