Updated on August 14.

The prices of CORSIA-eligible credits have been consistently declining throughout the year, along with other contracts. In July, there was an uptick of 89.74% in Future Dec-23 standardised contracts compared to the previous month, triggered by the announcement from the Voluntary Carbon Markets Integrity Initiative (VCMI) regarding the usage of offsets according to its code of practice.

While CORSIA-eligible credits are initially intended to assist airlines in achieving their climate ambitions, the acknowledgement of the attributes of these credits by the VCMI adds further validation to these contracts. This recognition could potentially contribute to a continued increase in demand for these credits, subsequently influencing their prices.

The prices of CORSIA-eligible credits have shown a consistent decline over the course of the year, mirroring the trend observed in other contracts as per observed in Graph 1.

Graph 1 – CBL Futures Dec-23 and spot settlement price

In July, there was a notable uptick of 89.74% in Future Dec-23 standardised contracts compared to the previous month, triggered by the announcement from the from the Voluntary Carbon Markets Integrity Initiative (VCMI) that while the Core Carbon Principles (CCP) labelled credits are not yet available, CORSIA credits for the pilot and first period would be accepted for its Platinum, Gold, and Silver Claims.

Shortly after, the Integrity Council (IC-VCM) determined that programs already eligible under CORSIA are also eligible under this version of the Assessment Framework for the CCP label if they meet additional requirements.

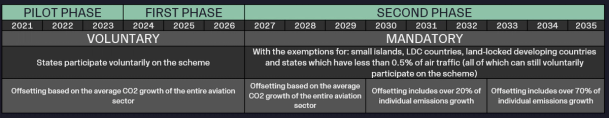

In 2016, the International Civil Aviation Organization (ICAO) adopted the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). Overall, CORSIA is designed to gradually increase the responsibility of individual operators in offsetting their carbon emissions, encouraging the aviation industry to mitigate its environmental impact. In the mandatory phase, complying with the scheme becomes mandatory for all air operators that are within states participating in the scheme.

The CORSIA baseline – from which airline offsetting requirements under the agreement are calculated – was agreed to be 2019 emissions for the period of 2021-2023. Then, ICAO set 85% of 2019 emissions as CORSIA’s baseline from 2024 until the end of the scheme in 2035.

The timeline of CORSIA implementation is as follows:

Figure 1 – CORSIA implementation timeline

Source: Veyt adapted from the International Civil Aviation Organization (ICAO).Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA).

As of May 2023, 121 states participate in CORSIA. The baseline emissions will need to be recalculated when the routes included in CORSIA change.

As more states participate in the voluntary phase, demand is expected to continue rising. Because of its compliance nature, demand will then be stabilized in the mandatory phase.

The Global Emission Offset (GEO) contracts are offsets that meet the eligibility criteria defined by the International Civil Aviation Organization for CORSIA.The GEOs are broadly demanded beyond just airlines looking to meet CORSIA compliance (e.g., telecommunications, technology, and manufacturing), since many corporate recognize the deliberate and comprehensive review process of the ICAO, and view it as a proxy for ensuring quality offsets are deliverable.

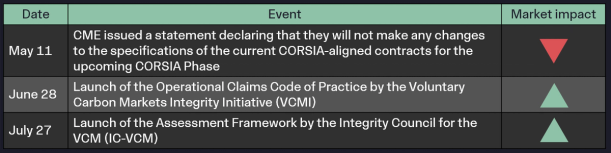

In Table 1 below is possible to see the main events in the market and their impact on the price of GEOs:

Table 1 – Events and market impact

In May, CME issued a statement declaring that they will not make any changes to the specifications of the current CORSIA-aligned contracts for the upcoming CORSIA Phase. The huge fall of the price by the end of May reaching the lowest level in the series indicates that market participants were compelled to sell off their positions in the existing CORSIA-eligible contract.

The recovery of prices soon after was the result of the launch (June 28) of the Operational Claims Code of Practice by the Voluntary Carbon Markets Integrity Initiative (VCMI). On the Code of Practice, VCMI acknowledged that companies must choose carbon credits that meet strict quality criteria aligned with the Core Carbon Principles (CCPs) set by the Integrity Council for the Voluntary Carbon Market (ICVCM). While CCP-label credits are not yet available, CORSIA credits for the pilot and first period will be accepted for its VCMI Platinum, Gold, and Silver Claims.

On 27 July, the IC-VCM launched its Assessment Framework determining that programs already eligible under CORSIA are also eligible under this version of the Assessment Framework provided that they meet some additional requirements.

For example, the programs must demonstrate transparent and robust corporate governance frameworks, including reporting, risk management policies, and anti-bribery measures. Independent boards, annual reports, and strong corporate social and environmental responsibility processes are required. Public engagement through stakeholder consultation and grievance resolution is also necessary. Requirements ensure clarity in the issuance and retirement of carbon credits, with detailed public disclosure of mitigation activities, calculations, and environmental impacts. Third-party auditing is vital to assess compliance with program rules and standards. To meet the criteria for robust independent third-party validation and verification, programs must outline rules for accrediting and reviewing verification bodies, ensuring their impartiality and avoidance of conflicts of interest. Transparency and public access to information are essential aspects highlighted by the ICVCM.

ICVCM is expected to start labelling credits in Q3 of this year, while companies are eager to adopt the VCMI Claims Code. This time gap means there might not be enough supply of ICVCM-labelled credits in the market by that point. As a result, companies may turn to CORSIA-labelled credits instead, which could potentially impact the current low prices.

The prices over the counter (directly sold by project developers or companies to buyers or through a broker) are currently between USD 2.88/t and USD 24.88/t, which an average price of USD 5.90/t, reflecting a premium to the standardized contracts, though the prices and buying demand have softened as well. Buying demand has been impacted by continued scrutiny and uncertainty of the VCM, leading to increased caution and due diligence when it comes to purchasing carbon credits, and fear of greenwashing accusations. Overall, fears of greenwashing, being under public scrutiny is undermining corporate demand.

In April 2020, on the recommendations of its Technical Advisory Board (TAO), ICAO approved the following six carbon offset registries to deliver eligible emission units (EEUs) for purchase and use under a pilot phase (2021-2023): American Carbon Registry (ACR), China GHG Voluntary Emission Reduction Program, Clean Develop Mechanism (CDM), Climate Action Reserve (CAR), The Gold Standard, and Verified Carbon Standard (Verra/VCS). Architecture for REDD+ was added in November 2020, Global Carbon Council (GCC) in March 2021, and the Forest Carbon Partnership Facility Program in November 2022.

The 9th edition of the CORSIA Eligible Emissions Units was launched on 24 March 2023 with the registries approved to supply the First Compliance Period. CORSIA eligibility requires that registries focus on public disclosure of its methodologies, protocols, scope of activities, procedures for issuances, retirements, tracking, and identification. The registries should address additionality, baseline calculations, quantification, monitoring, reporting and verification, chain of custody with trackable identification numbers, permanence, and leakage. The registries should also take measures to prevent double issuance, double use, and double claiming of offset credits. Offset projects must not cause net harm and should comply with social and environmental safeguards.

Offsets can originate from a diverse range of project activities, which encompass Land Use, Land Use Change and Forestry, Methane (CH4) capture, and its utilization in energy generation, as well as initiatives promoting energy efficiency and renewable energy. It is crucial to highlight that large-scale (over 7,000 tons emissions reductions/year) REDD+ and removal credits are not considered eligible within the framework of CORSIA.

The demand for CORSIA-eligible credits is expected to grow as more states join the voluntary phase, and it is anticipated to stabilize during the mandatory phase. Beyond airlines seeking CORSIA compliance, other industries, such as telecommunications, technology, and manufacturing, are also showing interest in GEOs due to the criteria conducted by ICAO, which intends to ensure the quality of offsets. Recent developments, such as the VCMI’s Operational Claims Code of Practice and the ICVCM’s Assessment Framework, are further enhancing the credibility and transparency of carbon credits, boosting the demand for CORSIA-eligible credits.

References:

IATA. Fact sheet: CORSIA. June 2023.

Veyt specialises in data, analysis, and insights for all significant low-carbon markets and renewable energy.