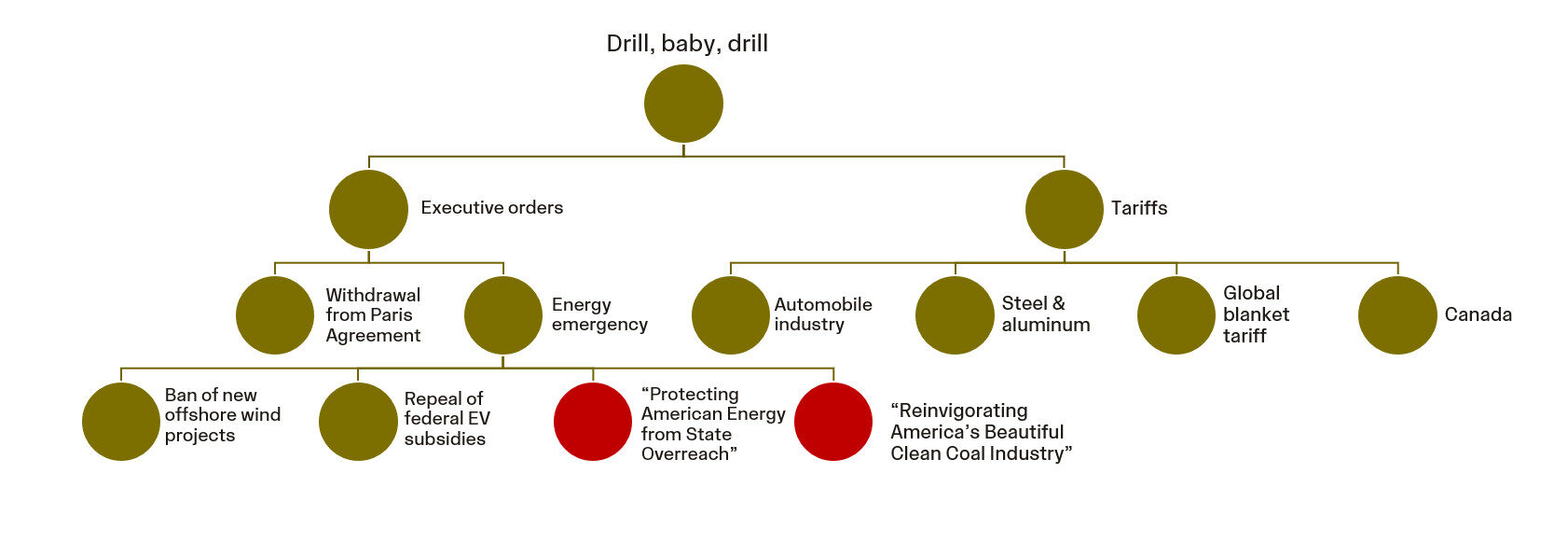

On Tuesday (8 Apr), Donald Trump signed two executive orders that aim to expand and protect the country’s fossil fuel industry. “Reinvigorating America’s Beautiful Clean Coal Industry” instructs government departments to remove barriers to coal mining and coal exploration on federal lands, and to implement measures that facilitate coal mining and coal-fired power generation. This comes following Trump’s pro-tariff, anti-climate agenda, where series of executive orders have been signed which aim to repeal federal environmental initiatives, see Figure 1, including withdrawing the Paris Agreement and banning new offshore wind projects. This new order calls on relevant federal agencies to include coal as an important energy source to strengthen American energy security. It specifically mentions the fossil fuel’s role in meeting the growing demand for electricity from the data centers needed by the artificial intelligence industry, and from projected growth in manufacturing. This includes having all federal agencies remove any language, funding, or plans that “discourage” coal in the country’s energy procurement efforts. The executive order further seeks to accelerate funding and deployment of coal technology and infrastructure for export.

“Protecting American Energy from State Overreach” claims that some US states discriminate or impose barriers to energy producers and that they regulate energy beyond their constitutional authority, thereby “undermining Federalism.” The order specifically mentions New York and Vermont, which have enacted legislation requiring fossil fuel companies to pay for their historic greenhouse gas emissions and climate change-related damages to the state. It also refers to California “adopting impossible caps on the amount of carbon businesses may use,” presumably meaning the cap-and-trade program between California and Quebec which constitutes the world’s second largest carbon market by traded value, WCI. The executive order does not explicitly mention RGGI, but mentions that such programs exist from “coast-to-coast”. It calls on the US Attorney General to find all states that have any such policies and programs and take action to stop them. The AG must then submit report to the president in 60 days outlining the actions taken.

Allowance prices in both the RGGI and WCI markets fell in the days after the release of these executive orders. The RGGI benchmark contract fell 21% (USD 4.62) from Tuesday to Thursday, (settling at USD 17.00/st) and the CCA benchmark contract dropped 10% (USD 2.85) to USD 26.98/t.

Though the steep price drops reflect uncertainty about what these executive orders could mean for the future of the two North American ETS, attempts to dismantle subnational carbon markets are not new. In his last presidency, the Trump administration tried to dismantle the WCI: the US Department of Justice took the state of California to court over its cap-and trade program, on grounds that it is an international agreement because Quebec is involved. Officials argued that participating in an ETS with the Canadian province constitutes “making treaties or compacts with foreign powers,” which only the federal government (not individual states) has the right to do according to the US constitution. A federal judge ruled against the administration in August 2020. The Trump administration appealed, but by the time the case came up again, Biden was president, and his justice department dropped the appeal.

California Governor Newsom called Protecting American Energy from State Overreach a “glorified press release masquerading as an executive order,” and the US Climate Alliance (a bipartisan coalition of US governors driving US decarbonization) released a statement confirming the executive branch “cannot unilaterally strip states’ independent constitutional authority.”

Similarly, a massive US coal revival is not in the cards. Donald Trump’s executive orders create the image of a US coal industry with mines and coal-fired power plants that exist (and could grow) but are being “discriminated against” by “climate-friendly” laws and regulations. In reality, coal-fired power generation and coal mining have been on a rapid decline in the US for decades – regardless of environmental legislation or carbon caps. The growing share of natural gas in the US fuel mix – a result of the surge in extraction due to advances in hydraulic fracturing that steeply reduced the cost of that cleaner fuel – has made coal unprofitable in the US for decades. In his last presidency, Trump rolled back environmental and safety regulations affecting coal production and consumption, but US coal companies went bankrupt in record numbers and power companies shut down coal-fired units at a record pace during that time. Coal-fired generation accounts for only 15% of US electricity today, half as much as in the year 2000. Mining jobs have been in decline for decades as automation has increased and health conditions like black lung disease have killed off the mining profession’s workers and bankrupted their employers.

Although a strong increase in US coal use would make for higher carbon prices in the two North American carbon markets – because emissions from the power sector would increase – such price dynamics are unlikely to play out as Trump’s attempts to revive an already dead coal industry will be unsuccessful.

In the same vein, the governors of the WCI and RGGI member states responded immediately to the executive order on state overreach, confirming the federal government’s inability to intervene on state-level programs. We therefore expect few further CCA and RGGI allowance price drops in the short-term. With federal tools for driving GHG reductions under threat, it is now up to state regulators to determine the future role of cap-and-trade programs in their decarbonization efforts. If regulators implement stringent cap reductions as a part of their program reform processes, despite these growing political sensitivities, allowance prices will maintain their bullish long-term outlook and play a more central role in incentivizing emission reductions in the coming years.

To discover how our advanced analytical tools can support your initiatives, reach out to our team at contact@veyt.com or visit veyt.com.

Stay ahead in renewable energy and carbon markets.

Sign up to receive expert analysis, market insights, and key policy updates—straight to your inbox, for free.

Specialising in data, analysis, and insights for all significant low-carbon markets and renewable energy.