Article

The hot air is gone: EU ETS has entered a new era

The European Commission annual calculation of the European carbon market surplus was released on 15 May, showing an ever diminishing surplus in the EU ETS. The market surplus is still more than 1.1 billion allowances, a number that will be the basis for the operation of the Market Stability Reserve over 12-month period from 1 September 2023 to 31 August 2024. Working with a 24 percent intake rate, 272 million allowances will be soaked up by the reserve in 2023. What is more; the invalidation provision is operational from 2023 onwards. Some 2.5 Gt of allowances – two years’ worth of emissions in the EU ETS - are wiped out for good, and with the revised legislation the maximum holding of the reserve will be 400 million EUAs in 2024. The market impact from cancelling allowances already stored away from the market should be nil. However, this is de facto tightening of the ambition level in the EU ETS and a signal that policymakers wanted to get rid of accumulated surplus or “hot air”. It truly signals a new era for the EU ETS.

Annual carbon market surplus calculation, with an add-on

The Commission on 15 May published the annual communication estimating the carbon market surplus – Total Number of Allowances in Circulation (TNAC). The verified emission numbers for 2022 released in April, is the basis for this status quo calculation of the accumulated supply of allowances in the EU ETS.

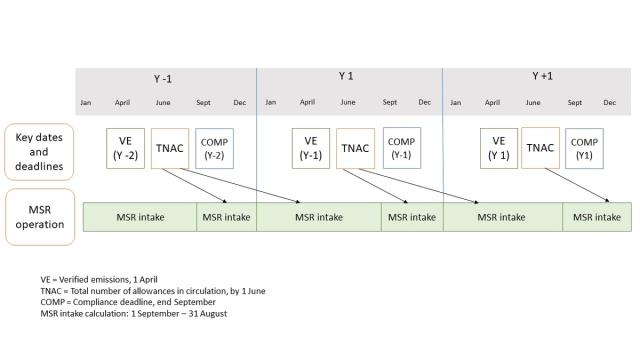

The Market Stability Reserve (MSR), in place to ensure that the carbon market stays in balance though eating up into the surplus in the market, operates on the basis of the TNAC. The number is the basis for the calculation of intake volumes to the MSR, and thus impacts the size of the auctions from 1 September this year to 31 August next year.

2023 is the first year the invalidation provision will be implemented. The provision was adopted back in 2018 in conjunction with the revision of the directive ahead of the fourth trading phase and implies a massive invalidation as from 1 January 2023 – for all practical purposes cancellation – of allowances from the Market Stability Reserve.

This analysis will explain the implications of the TNAC communication for MSR operation and market balance over next year and discuss the longer term impact of the invalidation for EU ETS balance.

The Market Stability Reserve at work

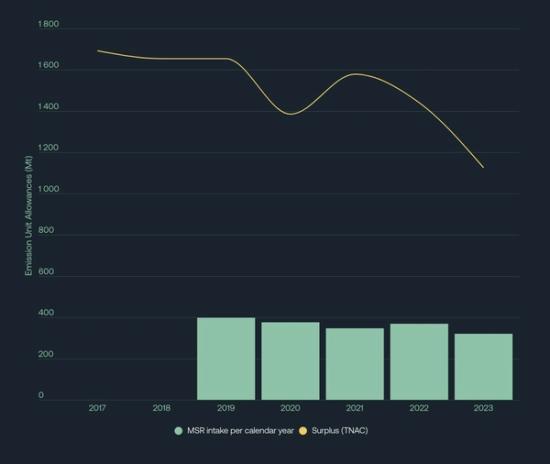

Due to the operation of the Market Stability Reserve, starting from 1 January 2019, the market surplus is shrinking year on year. The current TNAC, as calculated by the European Commission, is now 1.1 billion. This is a reduction of 307 Mt compared to last year’s number. As Figure 1 shows how the market surplus has been reduced year on year since the start of operation of the MSR.

With the MSR working with an intake rate of 24 percent of the surplus, 272 million allowances will be held back from the auction and placed in the reserve in the period from September 2023 to the end of August 2024. The MSR works with a time-lag of up to 1.5 years. The intake until September 2023 is based on the TNAC number released in May last year based on verified emissions for 2021.

The TNAC is now just above the threshold level of 1096 Mt, defined in the revised EU ETS legislation as the level where the new feature; the “buffer MSR” will kick in. We assume that next years TNAC will be below this number, and thus the MSR intake rate will not be fully 24 percent as this year, but follow the buffer-MSR logic (see Textbox 1). The buffer MSR ensures that the rate of intake to the MSR is slowed down to ease the market effect when the market is getting closer to being balanced (defined as when the surplus is between 833 Mt and 400 Mt)

The total intake to the MSR in 2023 will be 322 Mt (231 Mt Jan-Sept, 91 Mt Sept-Dec), compared to 368 Mt intake in 2022. We assume the intake is decreasing rapidly and will be further muted once the buffer MSR is at play. While the year on year the overall effect that the MSR has on market operations is getting smaller, the MSR will continue to be active in the coming years, and will continue to play an important role for the supply-demand balance over this trading phase.

---------------------------------------------------------------------------

Textbox 1: The relation between market surplus and MSR operation

- If the surplus is above the buffer MSR level of 1096 Mt à MSR will hold back 24% of the surplus

- If the surplus is between 1096 Mt and 833 Mt (the upper threhshold level), the buffer MSR kicks inn à The number of allowances placed in the MSR will be the difference in TNAC and 833 million. Eg. If TNAC= 950Mt, 117 Mt or 12% will be placed in MSR.

- If the surplus is between the upper threshold 833 Mt and the lower threshold 400 Mt à The MSR is muted and no intake to the reserve

- If the surplus falls below the lower threshold of 400 Mt à The MSR releases allowances to the market and 100 Mt is placed on the auctions annually.

----------------------------------------------------------------------------------

“Same procedure as every year”

In a press release on 10 May giving heads up for the TNAC publication, the Commission clarified that the publication of the TNAC number will be released before 1 June each year. This is a slight delay compared to the 15 May deadline currently in place. We see this as a mere clarification that there will be little changes to this process compared to now. While with the revised EU ETS directive the deadline for compliance has been pushed out to September from May starting 2024, this has obviously no implication for the TNAC calculation which is based on verified emission numbers published on 1 April each year. Hence, the MSR operations will continue to be settled with the same timeframes as today.

Invalidation means the future buffer is gone

For the first time the TNAC communication also contains a column for invalidated allowances sitting in the Market Stability Reserve. Since its start of operation, the MSR has been filled with allowances held back from the annual auctions as well as one-off entry of backloaded allowances and unallocated allowances from the third trading phase. Ahead of the invalidation the reserve contained some 3 Gt of allowances.

Back in 2018, during the EU ETS revision to align the legislation with the, then, 40 percent economy wide reduction target, EU policymakers agreed that in 2023, a huge volume of the allowances stored in the MSR should be invalidated. The provision is that the MSR should not hold more volumes than then previous year’s auction volumes. In 2022, a total 487.5 million EUAs were auctioned. In line with the provision, 2.5 Gt of EUAs are now invalidated – for all practical purposes cancelled.This is roughly two years of emissions in the EU ETS, hence a massive reduction in the permits to pollute. This will not affect the market balance today – as the invalidated allowances are already removed from the market sitting in the MSR, but it has huge ramifications for the future.

The fit for 55 revision process refined the invalidation rule in order to ensure more predictability, fixing the maximum volume in the MSR to an absolute number: 400 Mt. The Commission clarified that this will take effect with the next TNAC release by 1 June in 2024. Each year going forward, the holdings of the MSR will be revisitied, with excess allowances above the 400 Mt limit invalidate with the TNAC-release.

With the rapidly decreasing cap, the future is tight already in 2030, and with the current linear reduction factor the cap reach zero in 2040. We discuss what this means for the EU ETS in our previous analysis The path to net zero in the EU ETS ends in 2040. Containing a maximum of 400 Mt, the MSR can only help ease a tight market balance for a limited time of four years (see Textbox 1). The invalidation provision is a de facto tightening of the ambition level in the EU ETS and a signal that policymakers are determined to get rid of “old” surplus or “hot air” which had been accumulated before the MSR came into operation. It truly signals a new era for the EU ETS.

“The 27”

A parenthesis in this regard, but key to the compromise reached last year on the sourcing for REPowerEU funding, 27 million allowances that were destined for invalidation is set to remain in the MSR on top of the allowances available in MSR after invalidation. These 27 Mt are “spared” from invalidation as they will be used to replenish the Innovation Fund. This will be implemented from 2024. The timing for auctioning of these 27 Mt is not decided, but we assume this to be one of several elements that will be settled in the upcoming revision of the Auction Regulation. The Commission recently clarified that it expected the process to be completed by the summer.

Market impact of TNAC publication

The actual effect of invalidation on the supply-demand balance will only be felt toward the end of this trading period or start of the fifth trading period, when the surplus approaches and eventually falls below the lower threshold level. Also, the publication of the number of allowances to the invalidated is a mere implementation of the fit for 55 legislation, so no real surprises here.

In the short term, market participants' interest will rather be focused on the implication of the TNAC on MSR operations. Again, no real surprises, as the TNAC number reflects the verified emissions published on 1 April. These came in lower than many analysts, including us, expected, as industry turned out to more severely hit by demand destruction in 2022. Lower emissions, means higher surplus, means higher intake to the MSR. From September to December this year the intake to the MSR per auction will be lower than in the period January through September, where the MSR intake is based on 2021 verified emissions (see figure 2). On top of this the 16.5 Mt from member states future auction volumes will be spread over auctions from (assumed) July to December for REPowerEU-monetisation. From a pure supply-demand-perspective, this paints a bearish picture for the upcoming autumn. However, as discussed in our latest price forecast, both the shadow of a tighter future with the more aggressive linear reduction factor and the first one-off rebasing of the cap reducing supply next year and the gas and weather outlook for next winter will increasingly be factored in as 2024 approaches.